The coronavirus pandemic set in motion a cascade of changes in healthcare, and no sector was impacted more than digital health. The fledgling industry rapidly accelerated as COVID-19 changed technology helping patients receive care outside of the hospital or doctor's office into a necessity, instead of a luxury.

That acceleration has continued into 2021, and could even increase this year, experts say, creating a sea change in healthcare delivery and operations. Global healthcare industry revenues are expected to exceed $2.6 trillion by 2025, up from $2 trillion last year, with the majority of that growth propelled by artificial intelligence and telehealth, according to consultancy Frost & Sullivan.

Much of that growth could take place as the U.S. continues to grapple with the pandemic. As tech and data sharing becomes more pervasive, healthcare will likely pivot to become more predictive instead of reactive. Virtual care will continue to invade previously analogue modes of care delivery, giving rise to new modalities of care, and companies will invest more in cybersecurity as a result.

It's a time of historic volatility and few sure bets. But here's what experts are prepping for in digital health this year.

Healthcare continues to become more predictive

Healthcare will become more proactive as it moves toward being more predictive, according to Thomas Kiesau, director and digital health leader with advisory firm The Chartis Group.

Connected devices, both at the consumer level and clinical grade, will become more common, helping physicians get real-time data from patients to better monitor their health status, making interventions more "timely and more context-aware," Keisau said.

Along with greater proliferation of wearables, artificial intelligence is a key facet of this change. Proponents of the technology have long heralded AI with potential to transform healthcare functions, from clinical trials and drug discovery, to back-end administrative processes, to complex illness diagnosis.

Investment in AI has exploded of late. With the advent of the cloud, which allows organizations to ingest and analyze large amounts of data, AI could help drive major insights in care while saving the industry a lot of money. According to a 2019 Optum survey, senior health executives plan to spend almost $40 million over the next five years on AI-related projects, compared to an estimated $32.7 million in 2018.

However, industry could also see this year a greater backlash on algorithms, which were used in 2020 to prioritize vaccine distribution and resource allocation in hospitals hard hit by COVID-19. The widespread use of AI to choose who gets what at such a pivotal public health time has raised valid yet difficult questions about how machines make decisions, and whether their decisions are in the best interest of patient care.

In 2021, industry could see further oversight of AI for healthcare use cases, especially those in the exam room, to try to address these questions of data bias, difficulties in scaling algorithms to different settings, interpreting the AI decisionmaking process and addressing liability, among others.

"If an AI makes a mistake, who's liable for that?," said Karen Howard, the director of science, technology assessment and analytics for the Government Accountability Office, at a late January webinar on AI policymaking.

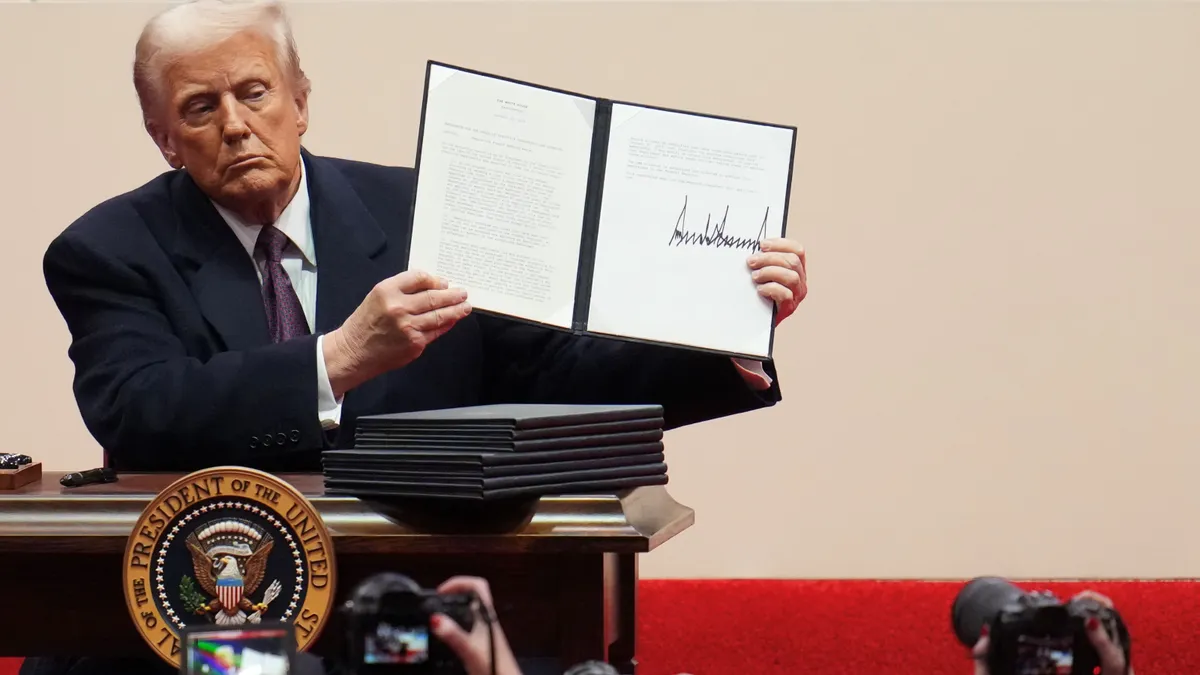

Scant days before the inauguration of President Joe Biden, the outgoing Trump administration created a new office to oversee AI research and policymaking, while the Food and Drug Administration released an action plan to improve oversight of AI in healthcare. The moves, though from a departed administration, could signal a desire in Washington to increase regulation of the nascent industry, though HHS also proposed in January permanently exempting a number of products using AI to diagnose illnesses on medical images from FDA review.

It's a thorny issue, and one that will likely get more play this year as predictive tools become more commonplace in the healthcare industry.

Telehealth continues to snowball

The virtual care industry saw unprecedented growth last year as the coronavirus pandemic led patients to look for avenues to access the healthcare system at home. Growth will likely continue if not accelerate in 2021, experts say, as virtual care options expand while integrating further with in-person care.

Automated screening, triage and routine care use cases will continue to move beyond simple urgent care and the prescription refills that used to characterize telehealth. This will be most evident in the areas of virtual diagnostics, patient-reported outcomes applications and digital homecare platforms, according to Avalere Principal Tim Epple.

"Healthcare will witness virtualization to a large extent," said Chandni Mathur, senior industry analyst at Frost & Sullivan, and "novel business models will emerge to support this paradigm shift."

Telehealth companies have already evolved beyond the direct-to-consumer models, with even some of the freshest startups inking coverage deals with major payers and employers and vendor partnerships with health systems, integrating into the traditional delivery ecosystem. Increased acceptance of virtual care could also result in more comprehensive value-based models, as payers and providers look to bundle the offering for specific patient populations, like end-to-end care for patients with chronic conditions, for example.

"Value-based payment models may create lasting financial incentives for virtual care," Nathan Markward, principal research scientist at Avalere, said.

Rampant telehealth adoption has been driven in large part by novel regulatory flexibilities, especially Medicare coverage, now temporary for the duration of the public health emergency. It's still unclear how many will outlast COVID-19, though proponents of the tech are banking that some level of increased access will remain. But the groundwork is laid for a broader, more pervasive change in healthcare delivery that will be hard to roll back, especially in 2021.

Virtual care will also continue to increase access and interest in previously niche fields, like women's health and telemental health. Last year was a banner year for both fields, with mental health seeing a record high of equity funding accelerating in the fourth quarter, and women's health companies reporting a record number of deals, according to CB Insights. Both fields also reported a strong number of early stage deals in the fourth quarter, suggesting the industry is poised for further snowballing even after the pandemic comes under control.

As dollars continue to flow into the sectors this year, more startups will crop up and existing players will turn increasingly to M&A in a bid to claim larger market share.

"The consolidation we saw in mental health during 2020 will continue into next year but I think we'll see new trends appear too," Trip Hofer, CEO of virtual behavioral health startup AbleTo, said. "There's such a proliferation of investment dollars in the market that we can expect to see some organizations come and go if they don't produce the expected returns."

With rising technology, hospital at home will become more of a reality, too. New non-clinical sites of care will crop up, further accelerating a trend made into a necessity by COVID-19, though it doesn't sound the death knell for hospital-based acute care for high-acuity cases, Chartis Group's Kiesau said.

Just as providers look to invest in health tech to cost costs and reach patients at home, telemedicine companies could even look to acquire in-person care assets, including primary care practices, ambulatory surgery centers and more to smooth the online-offline handoff in areas with high patient densities, predicts Nikhil Krishnan, founder of health newsletter Out-Of-Pocket.

"Telemedicine companies will race to build the online-offline handoff faster than hospitals can build telemedicine workflows," Krishnan said.

As data is freed, cybersecurity becomes paramount

As a result of increased tech use and data sharing, along with the vaccine rollout effort and continuation of remote work, cybersecurity will become more of a focal point for healthcare companies in 2021, experts predict.

Over the past three years, the fourth quarter of 2020 was the second-biggest funding quarter to health cybersecurity companies, according to CB Insights. Reported data breaches in the U.S. healthcare sector increased by almost three times last year, per HHS data, with malicious actors targeting industry as it struggled to respond to COVID-19.

These worries carry into 2021, especially as the U.S. races to strengthen the vulnerable vaccine supply chain, according to Experian researchers. Additionally, the majority of COVID-19 contact tracing apps, meant to track and minimize the spread of the virus that need widespread use to be effective, don't employ sufficient security protections, making it easy for hackers to gain access to private information.

Attackers could look to the vaccine to conduct a massive phishing effort in 2021, as the public looks for information and updates on distribution, predicts James Carder, chief security officer for security company LogRhythm.

The rise of telehealth has also led to more cyberattacks. Telehealth providers reported a huge increase in targeted attacks last year as adoption skyrocketed, including a 30% increase in cybersecurity findings per domain, according to Security Scorecard.

And healthcare is still reeling from the massive ransomware attack on major hospital operator UHS in September, which brought the IT systems of all its 400 U.S. facilities down. The hospitals were forced to divert ambulances to other sites and fall back on backup paper operations, delaying test results and complicating needed care, though UHS said no patients were affected.

Heightened investment in cybersecurity also makes sense as two new HHS regulations meant to nudge the industry toward interoperability are taking effect in April. They will result in health data being shared more broadly, raising significant privacy and security concerns. Additionally, Trump administration regulatory rollbacks finalized in late 2020 include provisions allowing providers, including hospitals, to share cybersecurity software with one another, meaning the proliferation of such tech safeguards among physicians is likely to increase in 2021.