Edwards Lifesciences boosted full-year sales and earnings estimates on growth in transcatheter aortic valve replacement and said Larry Wood, longtime leader of the TAVR business, will leave the company.

Wood, Edwards’ corporate vice president of TAVR since 2007, will join Procept BioRobotics as CEO on Sept. 2, Procept announced.

Dan Lippis, a 15-year Edwards veteran currently overseeing the Japan, Greater China and Asia Pacific region, will replace Wood as head of TAVR, CEO Bernard Zovighian said Thursday on an earnings call.

Wood helped transform Edwards’ TAVR business into a multibillion-dollar franchise and will be hard to replace, but the company’s well-known technologies, compendium of clinical data and robust commercial organization help allay concerns, Stifel analyst Rick Wise wrote to clients.

Edwards reported a nearly 12% sales increase in the second quarter, driven by TAVR sales that beat the company’s expectations and continued adoption of repair and replacement devices to treat mitral and tricuspid valve diseases.

Zovighian attributed the accelerated TAVR sales to clinicians’ focus on data from the company’s Early TAVR study, released in October, that showed patients with severe aortic stenosis with no symptoms had better outcomes after a TAVR procedure than if managed through clinical surveillance.

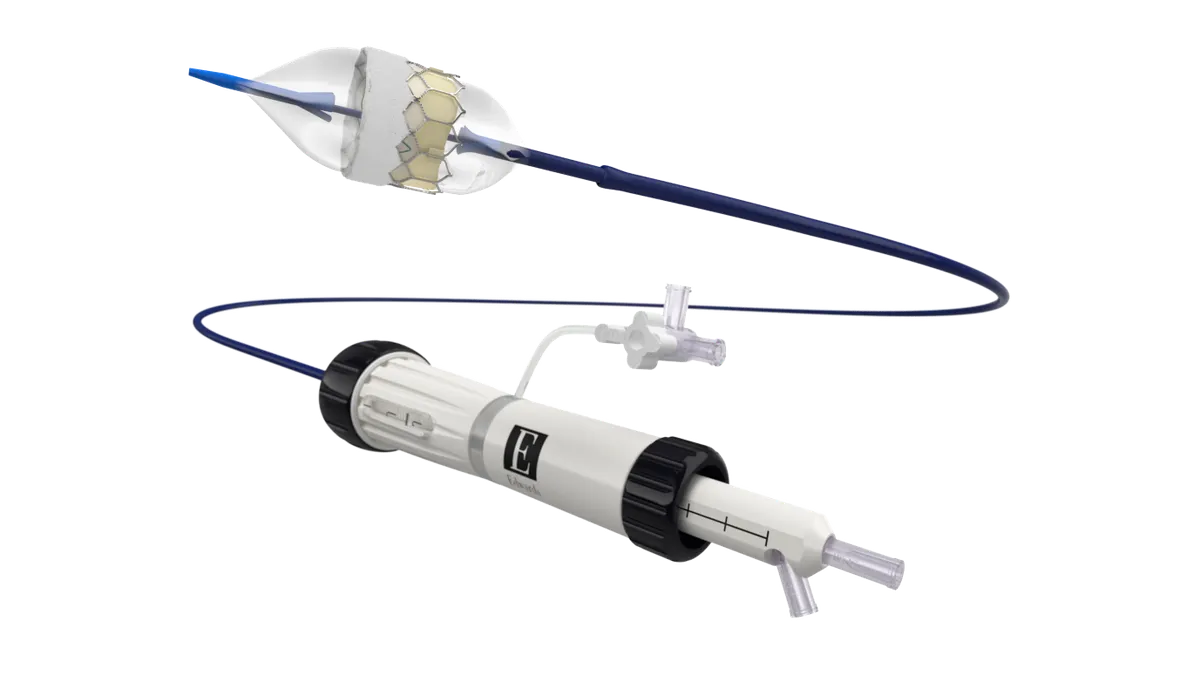

The company received an expanded U.S. label indication in May for use of the Sapien 3 TAVR platform in asymptomatic patients and has also gained approval in Europe for the patient population, becoming the first valve maker in both markets to offer the treatment for people without symptoms.

Boston Scientific’s decision in May to exit the TAVR market in Europe resulted in a “modest” contribution to Edwards’ sales in the quarter, the company said.

The renewed strength in TAVR, following a slowdown last year tied to heart team capacity challenges at hospitals, prompted Edwards to raise its full-year sales growth forecast to 9%-10% from 8%-10% and TAVR sales outlook to 6%-7% from 5%-7%. The company now expects adjusted earnings per share to be at the high end of a range of $2.40 to $2.50.

Mizuho Americas analyst Anthony Petrone, in a note following the earnings update, called the TAVR opportunity in severe asymptomatic cases “expansive” ahead of a potential Medicare national coverage decision and treatment guideline shifts that could come in the next year or so.

“The evolution of policy and guideline changes together with the potential of a new U.S. NCD will provide important catalysts, resulting in a multiyear growth opportunity for TAVR overall,” Zovighian said on the call.

In Edwards’ smaller but fast-growing mitral and tricuspid business, the CEO said both the Evoque tricuspid valve replacement and Pascal valve repair devices were significant contributors to growth as sales continue to scale up.

Zovighian said U.S. approval of the Sapien M3 transcatheter mitral valve replacement system is expected in the first half of 2026. Pivotal trial results are expected to be presented at the Transcatheter Cardiovascular Therapeutics conference later this year.

Edwards gained Europe’s CE mark for Sapien M3 in April.