Hospital heart team capacity constraints continued to limit Edwards Lifesciences’ transcatheter aortic valve replacement (TAVR) sales in the third quarter of 2024, company executives said Thursday on an earnings call.

Global sales of the aortic valves, which are Edwards’ biggest product, increased 6.5% in the quarter from the same period a year ago to $1.02 billion.

Edwards first disclosed the workflow logjam in July, noting the dilemma affecting its TAVR procedure volumes had come as a surprise. The weak second-quarter growth sparked a selloff in the company’s shares. On Thursday, executives provided further detail on the capacity situation at health systems.

Larry Wood, group president of TAVR and surgical structural heart, said some hospitals have physical constraints, while others are dealing with staffing issues. Patient backlogs for the procedure are growing, Wood said, so the issue is not a lack of demand.

“It's just putting tremendous pressure on the structural heart teams to be able to prioritize patients and to move patients around,” Wood said in response to an analyst’s question.

Some hospitals are investing in their structural heart space to address workflow needs, Wood said, adding that discussions with administrators about best practices to manage the challenges will continue “until this gets resolved.”

J.P. Morgan analyst Robbie Marcus, in a note to clients after the call, said it is unclear when the hospital utilization woes affecting Edwards’ TAVR sales will improve.

“We think it will take additional quarters for Edwards to convince investors that we’ve found the bottom for the TAVR franchise,” Marcus wrote.

Edwards' competitive position and pricing for TAVR were stable despite some regional pressures, and the rollout of the Sapien 3 Ultra Resilia device helped the company gain market share in Europe, CEO Bernard Zovighian said.

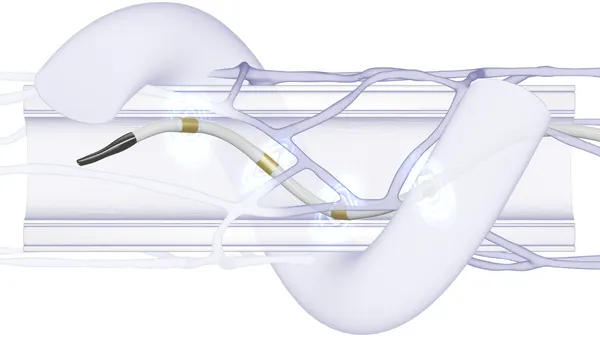

In the transcatheter mitral and tricuspid therapies (TMTT) business, sales climbed 73% to $91 million in the third quarter from the prior-year period, propelled by the Pascal valve repair system and continued introduction of the Evoque replacement device in the U.S. and Europe.

Edwards executives reiterated that the rapid adoption of those devices has contributed to the hospital heart team constraints that are dampening its TAVR sales. “Frankly, we’re part of the problem,” Wood said.

The company will present results from its highly anticipated Early TAVR clinical trial next week at the Cardiovascular Research Foundation’s Transcatheter Cardiovascular Therapeutics (TCT) annual scientific symposium. The study is evaluating the impact of early intervention with TAVR in asymptomatic severe aortic stenosis patients.

Edwards also will release data at TCT from the Triscend II pivotal trial studying Evoque valve replacement in patients with severe tricuspid regurgitation.

“Assuming both trials are positive, these two datasets could help position Edwards for a more-confident 2025 outlook and may yield an improved investor mindset as well,” Stifel analyst Rick Wise said Thursday in a report.