The abrupt resignation of Illumina CEO Francis deSouza, less than a month after a proxy battle led by activist investor Carl Icahn helped persuade shareholders to oust the company’s chairman, signals a change of direction at the gene sequencing pioneer.

Could that include a reversal of deSouza’s resistance to orders from U.S. and European anti-trust regulators to divest cancer test maker Grail?

Until the end, DeSouza remained a staunch defender of the company’s decision to acquire Grail, telling Illumina employees in a letter disclosing his resignation that his belief in the merger of the two businesses “remains unshakeable.”

Illumina has been appealing orders from both the European Commission and U.S. Federal Trade Commission to unwind its purchase of Grail, which it bought for $8 billion two years ago without regulators’ approval.

Before stepping down this weekend as CEO of Illumina, deSouza had held onto his board seat, with 71% of shareholders voting in favor of retaining him.

“With the loudest proponent of GRAIL not at the table anymore, the potential for a GRAIL divestiture rises meaningfully,” SVB Securities analyst Puneet Souda wrote in a note to clients.

Icahn candidate Andrew Teno won a seat on the board, and shareholders voted out Illumina’s former board chair John Thompson. Stephen MacMillan, who is CEO of Hologic and the former CEO of Stryker, joined the company’s board a week later as non-executive chair. Edward Lifesciences CFO Scott Ullem also joined the board, after Illumina expanded it to 11 seats from nine.

“Under a new CEO (who was not involved in the decision to close Grail ahead of regulatory approval), the potential for a quicker resolution on Grail is possible,” Evercore ISI analyst Vijay Kumar wrote in a research note.

Illumina has installed Charles Dadswell, its senior vice president and general counsel, as interim CEO while it searches for a permanent replacement for deSouza.

“We had suspected that the board would only consider more significant changes if financial results did not improve quickly or if U.S. or EU regulators maintained their unwinding orders following the appeals processes, which are scheduled to complete in late 2023 or early 2024. With this CEO change though, more significant strategic changes may happen quicker than anticipated,” Morningstar analyst Julie Utterback wrote in a research note.

Icahn launched a battle to oust deSouza, board chair John Thompson and a third board member, and replace them with his own nominees. He blamed them for a nearly 50% drop in the company’s share price, and for digging their heels in against regulators.

“For the sake of both Illumina and GRAIL, these companies should be separated immediately to protect the long term growth prospects and viability of each entity,” Icahn wrote in an April 5 letter to Illumina shareholders. “We believe the board of directors should dismiss Mr. deSouza immediately and bring back Jay Flatley [a former Illumina CEO] (or someone else on his level) as CEO,” wrote Icahn.

“Overall, we continue to hope Illumina will be able to strike a balance with Grail, which looks like a promising long-term opportunity but is draining Illumina's resources and earnings potential now with its $670 million expected operating loss in 2023,” wrote Morningstar’s Utterback. She added that a tax-free spinoff of Grail to Illumina shareholders, would leave investors a stake in Grail, which she called a “promising but nascent asset,” while boosting the value of Illumina’s core genomic sequencing business, which she said is “currently operating below its long-term profit potential.”

Canaccord Genuity analyst Kyle Mikson said he hopes deSouza's resignation will help investors focus on the company's promising long-term growth potential.

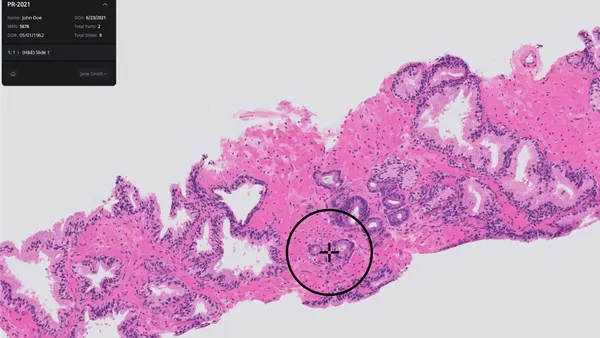

“In our view, ILMN should emphasize its NovaSeq X rollout and utilization, while increasing its participation in population genomics projects, clinical sequencing applications and advance monetization of its extensive dataset,” Mikson said.

Updates with additional comment from analysts.