With the launch of two new products, Penumbra hopes to grow its business and change how blood clots are treated. The Alameda, Calif.-based medical device company makes devices to remove clots from the brain, arteries and veins.

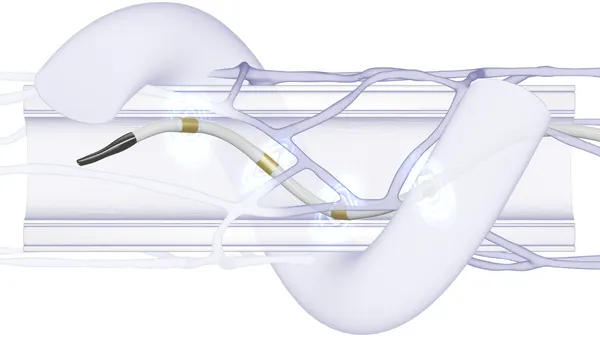

Its two newest devices — the Lightning Bolt 7, which is designed to remove clots from the arteries, and Lightning Flash, which treats veins and pulmonary arteries — use algorithms and sensors to control suction, ensuring the clot is being removed while minimizing blood loss. The company is also working on a trial of a third device, called Thunderbolt, for removing clots in the brain.

J.P. Morgan analysts have said they expect the new products to drive market share gains for Penumbra in the next six to 18 months.

Penumbra CEO Adam Elsesser talked with Medtech Dive about changes in treatment, competition and the company’s growth expectations.

This interview has been edited for length and clarity.

MEDTECH DIVE: Big picture, how has treatment for blood clots changed over time?

ADAM ELSESSER: When we first started, when we were focused initially just on the brain. There was, for the most part, nothing, with some people using tPA [tissue plasminogen activator], which is a drug that drips in and can dissolve the clot, but it comes with the risk of having a hemorrhage.

We thought that we could do better than that. But there [were] also a lot of people who were reluctant. Most of that is done out of the right thinking — like, let's do no harm — but it also requires where there's no harm, at least we can try to do better. So it's been a process.

For example, if you look at Lightning Bolt 7, which we just launched, the majority of those patients that have a blood clot in their arteries in their leg are treated by open surgery today. This speeds it up and makes it more automated, so that we're seeing a lot of folks who were doing that surgery go, “well yeah, I should try that.”

What’s the difference for patients?

For Lightning Bolt 7 — this is the arterial product we just launched — it depends on what happens. If you have to have open surgery, that's the primary [treatment].

Other people drip tPA. They have to do it really slowly, because they need a big bolus. So they do it over a period of typically two-plus days where they're slowly dripping tPA through a catheter at the face of the clot. They have to typically do that in a monitored bed or the ICU, because there’s a risk — it’s not a high risk — that you could have a hemorrhage because of that tPA drip in your leg.

The other big issue of course is if you don't get the clot out, then there's a pretty high likelihood of having your leg amputated. Because if you have an ischemic event down there, the tissue beyond the clot is no longer viable. And so in addition to patient comfort, the clinical endpoint typically is reduced amputation rates.

Since you've launched these products, what's the uptake been like from surgeons?

There's a lot of excitement, and we're seeing customers who have not otherwise taken on our products before start to be interested in trying them, and [those who] have tried them have lots of success.

Physicians who have used other things like surgery or lytic, but also in DVT [deep vein thrombosis] and PE [pulmonary embolism] where they're using other companies’ mechanical products that would typically compete with us — many of them would say for a while, “I like what I have,” and then [they’re] all of a sudden saying, “you can come and talk to me. I'm pretty interested in this new thing.” That's obviously fun and satisfying that we've been able to do that work.

Do any of your competitors have similar technology?

We're the only company that has what we call computer-orchestrated aspiration. This is the first time we have some nice intellectual property protection around our designs and ideas, so it will be hard for others to copy this. We've never had that luxury, if you will.

You’re currently running a clinical trial of a device for treating strokes called Thunderbolt. When do you plan to bring that to market?

We had a certain timeframe. It's going a touch slower, which we've said publicly. We'll put out additional updated timelines in the next quarter, but that business is doing really well anyway, so it's fine, and it will come when it comes.

You have said that you expect 23% to 25% revenue growth for 2023. What are some of the things that are driving that growth?

The first phase is the introduction of these two products, and the people using them, and that's shown an uptick in the overall use of our products. But the real topic going forward, and the reason I think we have a lot of confidence: There are approximately 800,000 patients who have a clot in the U.S. alone, who have a clot in their arteries, or their veins or their lungs. When you add that up, we as a field — not just us as a company — are treating way less than 10% of them. And so there's this huge opportunity to help a lot more people.