Pulsed field ablation (PFA) could soon account for the majority of electrophysiology procedures to treat atrial fibrillation (AFib) as Medtronic, Boston Scientific and Johnson & Johnson compete in one of the fastest-growing sectors in medtech, according to a new survey by Citi Research.

A second wave of PFA catheters and new mapping devices launched this fall are expected to accelerate use of the procedure and drive market share shifts in 2025, Citi analysts predict.

A group of 72 physicians surveyed by Citi on average expect 49% of their AFib procedures will use PFA devices in 2025, up from 39% this year. Radiofrequency ablation, currently the most common approach at 40%, will decline to 33% of all procedures, while cryoablation will slip to 18% from 21%, the survey found.

PFA uses short pulses to create tiny pores in targeted cardiac tissue, disrupting the electrical signals that cause irregular heartbeats. The method has surged in popularity because it can reduce the risk of damage to surrounding tissue and shorten procedure times, compared with traditional ablation techniques.

“PFA mindshare continues to accelerate among providers, gaining utilization over both radiofrequency (RF) and cryoablation (cryo),” Citi analyst Joanne Wuensch wrote in the report Thursday.

Four PFA systems have launched in the U.S. in the past year: Medtronic’s PulseSelect and Affera Sphere-9, Boston Scientific’s Farapulse and J&J's Varipulse.

What doctors are saying

The Citi survey polled 36 electrophysiologists and 36 cardiovascular surgeons to assess the market. It found that for PFA procedures, the physicians expected to shift next year to 56% Medtronic (11% PulseSelect and 45% Affera), 33% Boston Scientific and 10% J&J.

Those doctors now primarily use Medtronic’s PulseSelect (53%) and Boston Scientific’s Farapulse (43%), the two devices earliest to market.

“In 2025, Medtronic’s Affera system is expected to cannibalize most of its PulseSelect share, while the introduction of Johnson & Johnson’s Varipulse is expected to eat into Boston Scientific’s Farapulse,” Wuensch wrote.

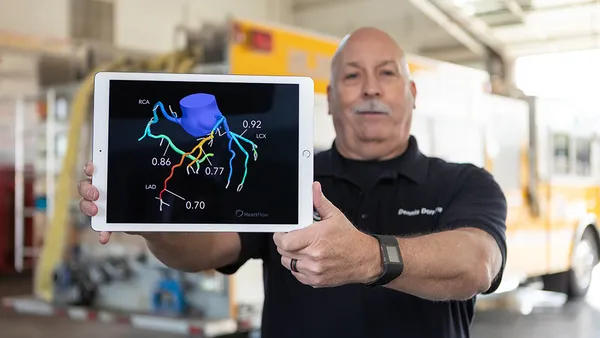

Overall use of cardiac mapping technology, which allows doctors to track the heart’s electrical activity during an ablation procedure, was seen rising to 70% in 2025, up from 68% this year.

Wuensch said new mapping device introductions would “shake up the current share landscape” in the year ahead. The providers surveyed expected to use mapping systems from J&J (35%), Abbott (33%), Medtronic (16%) and Boston Scientific (14%) next year. The group used mostly J&J (50%) and Abbott (44%) mapping devices in the past two years.

Stifel analyst Rick Wise, in a November research report, said the rapid FDA approval cadence of mapping-integrated PFA technology for Boston Scientific and Medtronic in October and J&J in November points to 2025 “as the year in which PFA potentially becomes the dominant afib ablation energy form.”

Electrophysiology outlook

Needham analyst Mike Matson, in a note to clients this month, said Boston Scientific’s Farapulse “has been the initial winner” in the electrophysiology market, boosting the company’s share by more than 10% since Farapulse obtained FDA approval in January. But Matson expects the share gains to slow in 2025 given the new PFA systems from Medtronic and J&J.

Needham estimates Abbott had a 22% share of the electrophysiology market in the third quarter.

Abbott, which has completed enrollment in a pivotal trial for its Volt PFA system, is on track for a potential FDA approval in the second half of 2026, Matson said.