Dive Brief:

- Vicarious Surgical CFO William Kelly is leaving the robotics company after four years to pursue other career opportunities.

- Waltham, Massachusetts-based Vicarious said Friday it initiated a CFO succession process and will provide updates on that search. Kelly will help with the transition of his responsibilities before he departs on Jan. 2, 2025.

- Although Kelly’s exit “does not instill confidence,” it is unlikely to alter the development timeline for the company’s surgical robot, BTIG analyst Ryan Zimmerman said Friday in a note to investors. “It's more than likely that the CFO had opportunities that presented better near-term potential,” the analyst wrote.

Dive Insight:

Vicarious is among the startups chasing robotic surgery pioneer Intuitive Surgical, which has led the market in robot-assisted soft tissue procedures for more than two decades. Medical device heavyweights Medtronic and Johnson & Johnson are also investing to bring soft tissue robots to the U.S.

The companies are vying for a toehold in a global market that saw a 22% increase in procedures last year, according to Intuitive, which is now rolling out its fifth-generation da Vinci robot.

The $150 billion potential market for robotic surgery is 96% unpenetrated due to high costs, difficulty of use and other barriers to adoption, according to Vicarious’ estimates.

Founded a decade ago, Vicarious has received financing from Bill Gates and a string of other technology investors. In November, the company said it expected to complete its first clinical patient case within a year and reiterated its forecast for a full-year 2024 cash burn of about $50 million.

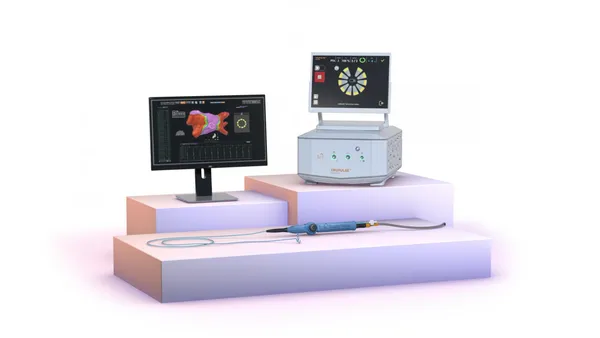

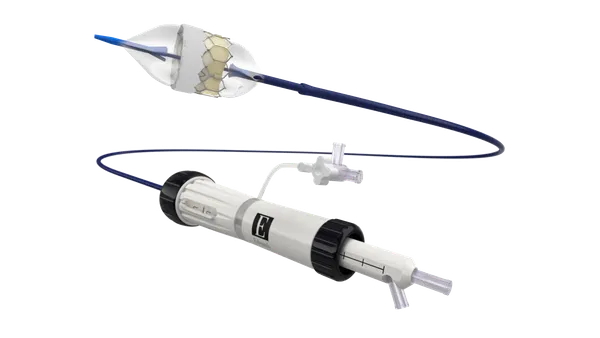

Vicarious is developing a single-port platform that it argues can bring greater efficiencies to minimally invasive surgery than multiport systems. Intuitive’s da Vinci 5 is a multiport system with four robotic arms; the company launched the single-port da Vinci SP system in 2018.

Vicarious cut spending and laid off workers last year to conserve cash. In June, it completed a 1-for-30 reverse stock split to increase its share trading price and bring the company into compliance with New York Stock Exchange listing requirements.

Kelly’s exit poses another challenge for Vicarious on the path to U.S. authorization of its robot, BTIG’s Zimmerman said, but “our read is that the CFO departure does not necessarily signal anything is wrong with the Vicarious System.”

Vicarious will likely need additional capital to get its system to market but appears on track to apply for Food and Drug Administration clearance in early to mid-2026, following clinical trials in 2025, Zimmerman said.