Abbott expects to launch its first pulsed field ablation (PFA) device outside of the U.S. in 2025, CEO Robert Ford told investors on Wednesday. A company spokesperson said Abbott expects to receive a CE Mark in the first half of 2025 and FDA approval in 2026.

PFA is a minimally invasive procedure that uses high-voltage electrical pulses to treat heart arrhythmias, offering an alternative to approaches that use heat or extreme cold. PFA is expected to be quickly adopted by physicians as evidence shows it could be faster and lead to fewer complications than other approaches.

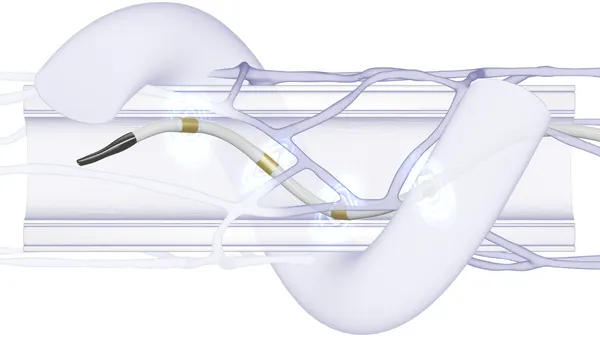

Medtronic, Boston Scientific and Johnson & Johnson have already introduced their own versions of the devices, although J&J has paused U.S. cases due to safety concerns. Abbott’s Volt PFA system pairs a balloon-in-basket catheter with a heart mapping solution.

The company’s electrophysiology segment reported $2.47 billion in sales in 2024, for year-over-year growth of 12.3%. Ford expects growth in the “high single-digits” for 2025, and possibly more growth in the second half “as Volt comes on board.”

“It's been pretty competitive in 2024. I expect that intensity to increase when it comes to the ablation catheters,” Ford said. “But I'm confident that we can maintain a strong position in the mapping segment and everything that comes with all the consumables that come with that.”

BTIG analyst Marie Thibault said in a Tuesday research note that Abbott plans to file an FDA submission sometime this year.

Diabetes care, structural heart drive growth

Ford called out diabetes care and structural heart as two other fast-growing segments.

The diabetes business reported sales of $6.81 billion in 2024, an 18.1% increase year over year, driven by continuous glucose monitors. Ford said he sees the biggest opportunity among people who take multiple shots of insulin per day, noting that roughly half of intensive insulin users internationally don’t use CGMs.

Ford also sees opportunities as more countries offer coverage for people who only take basal insulin, for more connectivity with insulin pumps and for sales of over-the-counter, wellness oriented devices.

Abbott launched its Lingo over-the-counter CGM last year “in a restricted number of U.S. cities,” Ford said. With a better understanding of this new group of users, Ford plans a national launch in the U.S. this year and to consider other international markets.

“In several areas, I think, it surpassed some of my expectations, especially regarding reorder rates,” Ford said.

The structural heart segment, which includes transcatheter cardiac valve repair products like Mitraclip and Triclip, reported sales of $2.25 billion in 2024, a 15.5% increase year over year. Although Mitraclip makes up the majority of sales, Abbott’s Amulet implant to reduce the risk of stroke and its Triclip device have done “very well,” Ford said.

“Structural heart represents one of the most attractive areas in the field of medical technologies,” Ford said. “It is an area that we have invested in heavily, and we're seeing those investments yield outstanding results.”