Abbott on Wednesday reported robust third-quarter sales growth across its base businesses, excluding COVID testing, and said it expects the strength to carry into next year even as macroeconomic challenges loom.

The company, which makes nutrition products, pharmaceuticals, diagnostics and medical devices, reported a double-digit organic sales increase for the third consecutive quarter as well as double-digit growth in all four of its segments, excluding COVID testing.

CEO Robert Ford told investors the company is well positioned to continue its growth heading into 2024 despite an uncertain operating environment. That includes investor worries about the impact of popular weight-loss drugs on demand for Abbott’s glucose monitors and the potential for reduced pricing in China, an important market for the company.

“Clearly, there’s going to be some macro environment challenges as companies head into 2024. But I’d say our portfolio has really been built to withstand this type of environment, and we tend to do pretty well in this type of environment,” Ford said.

Abbott boosted its full-year outlook for adjusted earnings per share, a day after industry bellwether Johnson & Johnson also raised its sales and earnings forecasts for 2023.

“For the second time this week, a large-cap diversified MedTech company showed that the Medical Device industry is still operating at strength, despite ongoing macro pressures,” Stifel analyst Rick Wise said Wednesday in a note to clients.

GLP-1 impact

Ford addressed persistent investor concerns about whether GLP-1 drugs could reduce demand for diabetes care devices such as Abbott’s FreeStyle Libre continuous glucose monitor, saying that a growing number of Libre users also take the weight-loss medications.

FreeStyle Libre sales climbed 30.5% to $1.4 billion in the third quarter. The number of people using the device has swelled to 5 million globally, with 2 million of those patients in the U.S., where the user base has nearly doubled over the past two years, Ford said.

“While we traditionally think of therapy choices as having to compete against one another, this is a good example of a complementary relationship between two products that both help optimize the treatment of diabetes,” the CEO said.

Other medtech

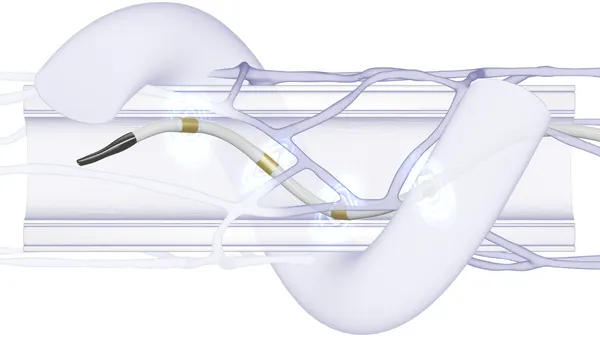

Medical device sales increased 16.6% overall in the third quarter, boosted by growth in diabetes care, electrophysiology, structural heart, and neuromodulation. The recent launch of the Aveir leadless pacemaker for both single- and dual-chamber pacing supported growth in the company’s cardiovascular business.

Outlook

Abbott narrowed its full-year 2023 earnings per share forecast to a range of $3.14 to $3.18 and forecast adjusted EPS of $4.42 to $4.46, which represents an increase at the midpoint of the guidance range.

The company continues to expect full-year 2023 organic sales growth, excluding COVID-19 testing-related sales, in the low double-digits.