Dive Brief:

- Baxter is considering the sale of its kidney care business to private equity firm Carlyle Group for more than $4 billion, The Wall Street Journal reported on Friday.

- Exclusive negotiations about a potential sale started in late June, the Journal reported, citing unnamed sources. A deal could be announced “in the coming weeks,” although the talks could still fall apart, according to the report. A Baxter spokesperson told MedTech Dive that the company does not comment on market rumors or speculation.

- Baxter announced plans in early 2023 to spin off its kidney care and acute therapies businesses into a separate, publicly traded company called Vantive. In March, the company said it was also considering selling the segment to private equity.

Dive Insight:

Baxter is pursuing “dual pathways” of a spinoff or planned sale of Vantive to a private equity investor, CEO Joe Almeida said in a May earnings call. He expects a separation to take place in the second half of 2024.

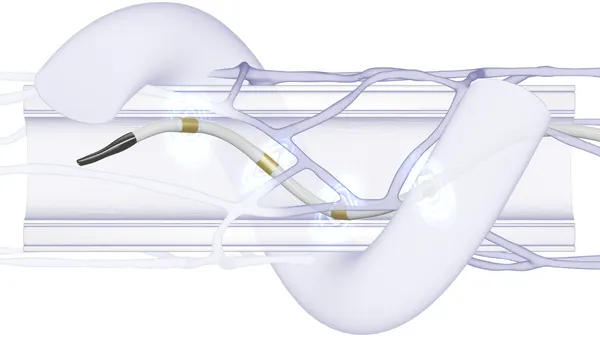

Vantive’s focus includes chronic and acute dialysis treatments and services. In 2023, the segment generated about $4.45 billion in sales, representing nearly a third of Baxter’s total revenue. Segment growth was flat year over year.

Carlyle Group would acquire Vantive for more than $4 billion, including debt, according to the Wall Street Journal.

The Washington, D.C.-based private equity firm has holdings in other medtech companies, including QuidelOrtho and Medline. Last year, Reuters reported Carlyle Group was a front-runner to buy Medtronic’s patient monitoring and respiratory care business for more than $7 billion.

Medtronic had been considering a sale or spinoff of the segments. However, Medtronic changed its plans in February, deciding instead to exit the ventilator business and combine its remaining patient monitoring and respiratory care assets into a new unit.