Dive Brief:

- Boston Scientific updated its forecast for pulsed field ablation (PFA) adoption, predicting that more than 60% of atrial fibrillation (AFib) procedures globally will use the technology by 2026.

- The forecast, which the company made at the J.P. Morgan Healthcare Conference Monday, is up from the 40% to 60% by 2026 prediction management provided before launching a PFA device.

- Boston Scientific CEO Mike Mahoney said the company is “a clear market leader” in PFA and the technology will fuel its rise from “a distant number four” in electrophysiology to number two this year.

Dive Insight:

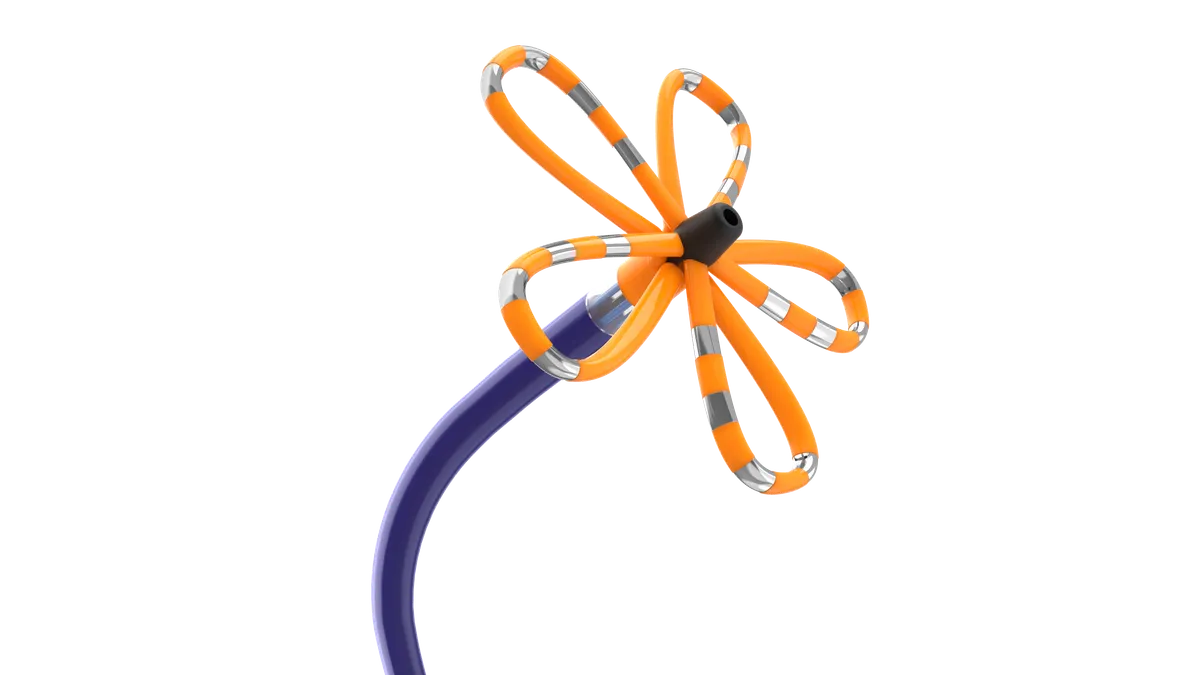

Mahoney predicted Boston Scientific will claim the number two spot in the electrophysiology market by mid-2025 and then mount a push to become number one “over the coming years.” The forecast comes 10 months into the launch of Boston Scientific’s Farapulse PFA device, which has helped drive the shift away from the use of radiofrequency energy and cryoablation to treat AFib.

Rivals have sought to mitigate Boston Scientific’s threat by developing their own PFA devices but Abbott has yet to win approval and Johnson & Johnson paused use of its device last week. That leaves Medtronic, which recently called cardiac ablation a $9 billion segment, as Boston Scientific’s current rival in PFA.

Boston Scientific reported a 177% increase in global electrophysiology sales in the third quarter, growing the business to $527 million. Medtronic reported mid-single digit growth in cardiac ablation products in its most recent quarterly results. Medtronic groups PFA and other ablation devices with a broader set of cardiac rhythm and heart failure products that generated sales of nearly $1.6 billion in the quarter.

After its successful PFA launch, Boston Scientific is embarking on initiatives to keep growing in 2025 and beyond. Evercore ISI analysts said in a note to investors that the company’s management “sounded very comfortable around sustainability of growth” at the J.P. Morgan event.

Boston Scientific’s PFA growth plan for 2025 includes expanding in China and Japan, further penetrating the U.S. and European markets and increasing use of its mapping system. Physicians can use Farapulse with rivals’ mapping systems or operate without software. Still, Boston Scientific Chief Medical Officer Ken Stein said at J.P. Morgan that he expects more use of the company’s Opal suite in 2025.

Additional clinical data and label expansions are part of Boston Scientific’s plans for growing PFA sales in the longer term. The franchise could benefit from a label expansion for another Boston Scientific product in 2025. Last year, a Boston Scientific-funded trial found performing left atrial appendage closure (LAAC) at the same time as ablation lowered the risk of bleeding compared to using blood thinners.

Boston Scientific sells a device, Watchman, that Mahoney said has a 90% share of the U.S. LAAC market. The company expects to expand the Watchman label to cover use in post-ablation patients in the second half of the year. Stein explained why performing ablation and LAAC at the same time is “as close to a no-brainer as anything ever gets in medicine” at J.P. Morgan.

“You're taking two procedures that both involve essentially the same skill set and the same approach to the patient. Instead of having to have two procedures and have the attendant risks doubled, you can do it all at one sitting,” Stein said. “It's great for patients, it's great for doctors and it's great for the whole ecosystem in terms of relieving some of the capacity constraints.”

Capacity constraints are a concern for Boston Scientific as it tries to rapidly ramp the use of its PFA and LAAC devices. Mahoney said lab capacity is “one of the few headwinds” the company could face in the future.

Boston Scientific predicted at J.P. Morgan that the LAAC market will grow from $1.4 billion in 2023 to more than $6 billion in 2030. The company made the same forecast at an investor event in 2023.