Dive Brief:

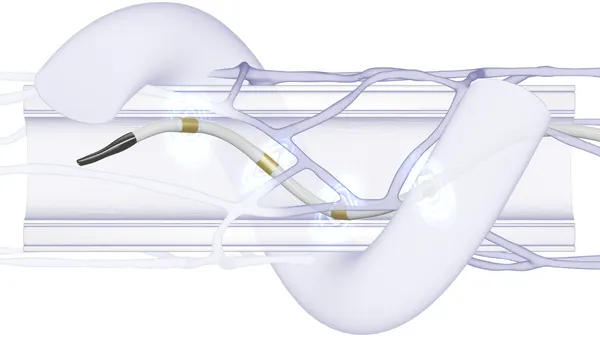

- Medtech companies could be affected by an anti-dumping investigation started by China’s Ministry of Commerce on Friday, questioning whether certain devices were exported at a lower price than their normal value. The inquiry concerns X-ray tubes from the U.S. and India, which are used in computed tomography machines.

- J.P. Morgan and BTIG analysts identified GE Healthcare as a company that could be affected, as imaging is the firm’s largest segment in China. A GE Healthcare spokesperson said the company does not believe the anti-dumping investigation is a material risk to its business in China.

- The investigation started two days after President Donald Trump raised tariffs on imports from China by 34%, for a total levy of 54%. “We don't know if this is purely coincidental or part of a broader retaliatory effort,” BTIG analyst Ryan Zimmerman wrote in a research note. China announced its own 34% tariff on U.S. goods Friday.

Dive Insight:

China’s Ministry of Commerce began the investigation after receiving a complaint in March from Kunshan Yiyuan Medical Technology, which makes X-ray tubes. The investigation began Friday and is expected to be completed before April 4, 2026. It may be extended by six months in special circumstances, the Ministry of Commerce wrote.

If the investigation finds evidence of dumping, or lower-priced exports, and that the domestic industry is being hurt, the exporting company can raise its price to an agreed level to avoid an import duty, Zimmerman wrote.

GE Healthcare’s stock fell nearly 16% on Friday, closing at $60.51.

GE Healthcare and Medtronic were among 20 companies invited to a roundtable discussion Sunday, where China’s Ministry of Commerce said it would protect the rights of foreign enterprises in China, including those from the U.S.

China is GE Healthcare’s third-largest region by sales, accounting for $2.36 billion in sales, or about 12% of total revenue in 2024.

About 70% of GE Healthcare’s China-made products are sold locally, Zimmerman wrote, adding that it’s not clear whether the Ministry of Commerce views the company as a local or multinational organization.

In a February earnings call, after Trump’s initial hike of tariffs on China but before the latest round of levies, CFO Jay Saccaro said GE Healthcare would watch the situation carefully.

“We think China is an attractive long-term market, but clearly, there's been some volatility,” Saccaro added.

J.P. Morgan analyst Robbie Marcus expects the investigation to have a modest impact on GE Healthcare's business in the short term. It’s not clear what the difference in pricing will be, and the X-ray tubes represent a fraction of the company’s CT system revenue, he wrote in a research note.

“Where we are more cautious, however, is on the long-term implications of this investigation, and what it signals for the broader imaging/MedTech sector as a whole in China,” Marcus wrote, adding that the Chinese government will likely take more measures in the future to favor local medtech firms over foreign competitors.

Other medtech companies, including Illumina, have been affected amid rising tensions between the U.S. and China. In February, the DNA sequencing firm was placed on China’s unreliable entity list, which experts said could drive domestic demand toward Chinese sequencing companies. The company’s DNA sequencers were also hit with an import ban in March.

Prior to the latest escalation, medical device companies had been navigating changing market dynamics in China. Last year, companies including GE Healthcare, Philips and Siemens Healthineers said sales in China fell amid the country’s anti-corruption campaign.

Editor’s note: This article has been updated with comments from GE Healthcare.