Dive Brief:

-

Haemonetics has struck a deal to buy Cardiva Medical for $510 million, giving it control of vascular closure systems.

-

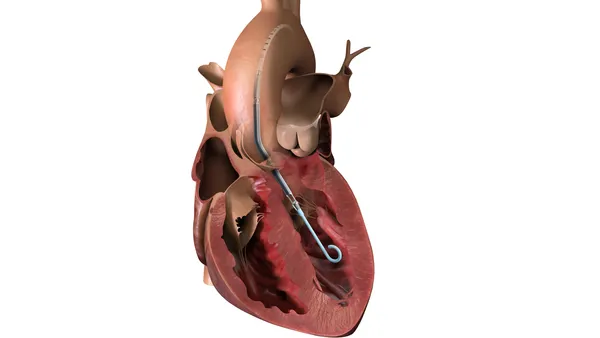

Cardiva sells two devices, Vascade and Vascade MVP, that use collagen plugs to close the vascular access sites created in catheter-based coronary, peripheral and electrophysiology procedures.

- Haemonetics entered into the takeover agreement to strengthen its "hospital portfolio in the attractive and fast-growing interventional cardiology and electrophysiology markets," CEO Chris Simon said on a conference call with investors.

Dive Insight:

Simon took charge of a turnaround effort when he joined Haemonetics as CEO in 2016. The effort saw Haemonetics cut jobs and sell a manufacturing facility and other assets. COVID-19 has hit sales, particularly at Haemonetics' plasma business, but Simon is nonetheless completing the turnaround agenda and looking to the next phase in the company's evolution.

Cardiva is central to that next phase. Simon argued the takeover "catalyzes [Haemonetics'] transition from turnaround to transformational growth" by moving it into fast-growing markets adjacent to its existing business. Haemonetics is paying $475 million and committing to up to $35 million based on sales growth.

Investors may take more convincing. Shares in Haemonetics fell almost 3% on a day of gains for the broader market. The takeover will eat into the $279 million Haemonetics had in cash as of Sept. 26 and cause it to take on a $150 million term loan on top of its existing revolving credit facility. On the operational side, Haemonetics will face the challenge of integrating Cardiva.

Simon sought to allay concerns about the integration process, telling investors that Stewart Strong, president, global hospital at Haemonetics, "has deep experience in interventional cardiology and acquiring and integrating businesses of similar size and nature."

In the first fiscal year, Haemonetics expects the acquisition to add up to $75 million to its revenues. The longer-term opportunity is much bigger. According to Simon, the takeover expands Haemonetics' total addressable hospital market opportunity from $1 billion to $2.4 billion.

Simon singled out the opportunity to grow penetration and utilization of Vascade MVP in ablation procedures in the U.S. as one source of future sales. Haemonetics also plans to use its international sales channels to take Cardiva's products into other geographies.

As Simon frames it, the takeover is about more than just adding Vascade and Vascade MVP to the Haemonetics portfolio. The CEO also talked up the "complementary sales organizations" of the two companies and the potential to drive innovation by combining their R&D.