Dive Brief:

- Heartflow’s initial public offering grossed $364.2 million after the volume and price of the shares sold exceeded the original expectations.

- The company listed last week and completed the sale of the overallotment on Monday, adding almost $50 million through the sale of additional shares.

- Heartflow’s stock rose in its first two days on public markets, closing at almost $30 on Monday. The company priced its IPO at $19 a share.

Dive Insight:

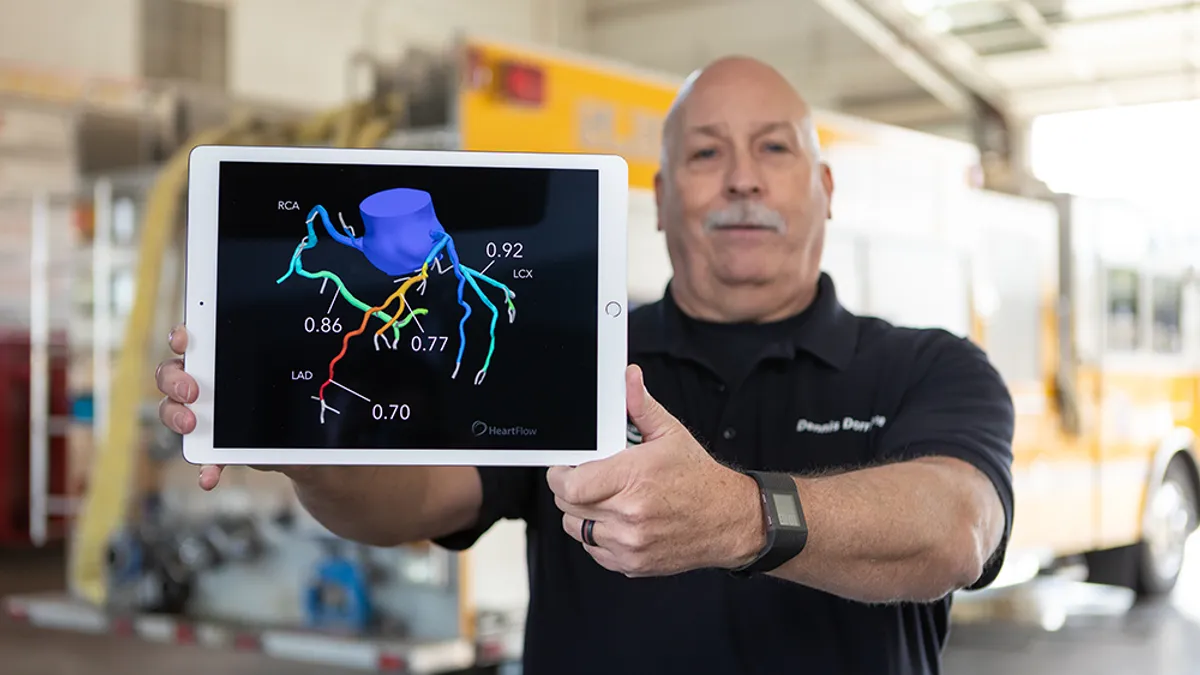

Heartflow has developed software for making 3D heart models from coronary computed tomography angiography scans. In a clinical trial, the company linked its lead product, Heartflow FFRCT Analysis, to a 78% improvement in identifying patients in need of revascularization.

Heartflow was aiming to sell 12.5 million shares for between $15 and $17 each when it set its IPO range early this month. At the midpoint of the range, the company would have raised $200 million before fees under the original plan.

By the time Heartflow finalized the terms last week, the company had agreed to sell 16.7 million shares for $19 each. The changes increased the initial gross IPO amount to $316.7 million. Heartflow raised a further $47.5 million when underwriters took up their options to buy an additional 2.5 million shares in the overallotment. The company estimates net proceeds after fees will be $333.2 million.

Heartflow’s first two days on public markets provided further evidence of investor enthusiasm. The stock closed at $28.75 on Friday. After peaking and troughing during Monday’s session, Heartflow closed up at just below $30. The closing price on Monday was almost 58% higher than the IPO price.

The offering extends a recent uptick in IPO activity. Caris Life Sciences priced its IPO at $21 in June, having originally set a range of $16 to $18, and the precision medicine company’s stock closed above $30 on Monday. Carlsmed hit the middle of its expected $14 to $16 range, raising more than $100 million to advance its spine platform, but its share price had slipped to $13 by market close on Monday.