Dive Brief:

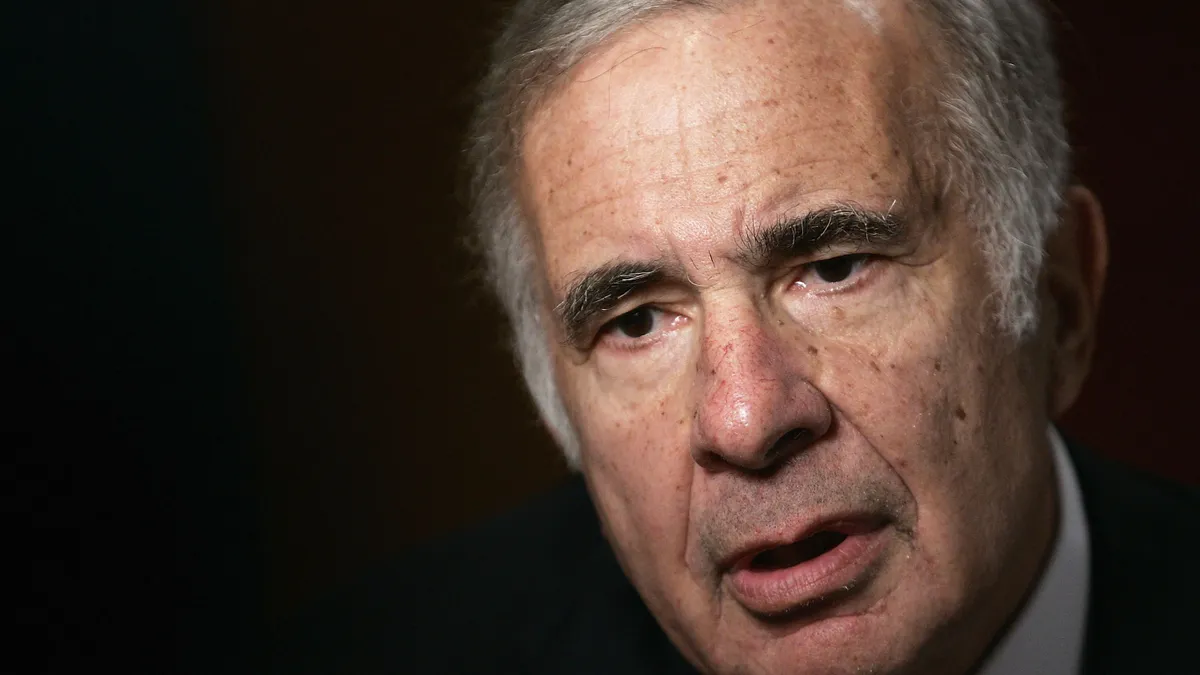

- Illumina stock closed up nearly 17% on Monday after activist investor Carl Icahn released a public letter to its shareholders declaring his intent to nominate three people to the board who can help “extricate” the San Diego-based DNA-sequencing company from a war with regulators over its 2021 purchase of liquid biopsy company Grail.

- Icahn said $50 billion in value has been wiped from Illumina’s market capitalization since August 2021, due to its “reckless” action in ignoring regulators’ advice not to close the Grail deal.

- Illumina, in a press release, said that it is working on a divestiture to meet the terms of an order from the European Commission. Stating that Icahn’s nominees for its board lack relevant skills and experience, the company recommended that shareholders not support them.

Dive Insight:

Illumina faces separate challenges from regulators in the U.S. and Europe and may be forced by the European Commission to divest Grail.

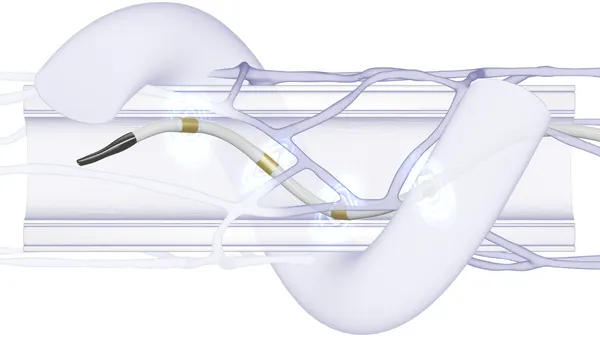

The company defended its $7.1 billion purchase of Grail in December in a hearing before the Federal Trade Commission, saying the deal would bring blood-based cancer detection tests known as liquid biopsies to market sooner.

However, Evercore ISI analyst Vijay Kumar, in an email, noted that Illumina will need to build a new sales force targeting doctors to sell the liquid biopsy test. Illumina sells instruments to researchers in academia and biopharma, while Grail’s cancer screening test will be marketed to general physicians.

“There is no synergy with academia and biopharma customers, who are (Illumina’s) core customer base,” Kumar said.

Icahn, in his letter to Illumina shareholders, said the company is now obligated to pay a fine to European regulators that could reach $458 million, and must hold the venture separate from the company at a cost of $800 million annually.

“Perhaps overpaying for the venture business can be forgiven, but it is inexplicable and unforgiveable that under these circumstances the management team and board of directors went ahead with the deal anyway without first ascertaining whether they would get clearance from the European regulators,” Icahn wrote.

In addition, if European regulators force the divestiture of Grail, Illumina could be forced to pay $1.75 billion in taxes, Icahn argued, if it can sell the business for the same price for which it was purchased.

Illumina said Icahn’s letter does not recognize the value that Grail can bring to shareholders or reflect an understanding of the regulatory process. Unless it wins a jurisdictional appeal, Illumina plans to execute a divestiture under terms of the European Commission's order, the company said.

It said it is not in shareholders’ best interest to support Icahn’s three nominees for its board: two current Icahn employees, Jesse Lynn and Andrew Teno, and one former Icahn employee, Vincent Intrieri.

But Icahn said Illumina will find it “almost impossible” to raise the capital needed to keep up its fight with regulators, and his nominees “are particularly suited because of their experience to help keep Illumina from sinking further into the quicksand.”

On Tuesday, Illumina’s shares rose another 1.64%, or $3.72, to $230.66 in midday trading. The shares are up 10.6%, or $22.33, to 230.66 over the past five days.

Updates share price.