Second quarter earnings season starts this week, with Johnson & Johnson, Abbott and Intuitive Surgical set to report results that will provide pointers to the current health of medtech markets.

Here’s what to look for in the first week of earnings for the industry:

1. Johnson & Johnson

In April, J&J said it expects medtech operational sales growth to be relatively consistent throughout the year. The company predicted procedure volumes would stay above pre-pandemic levels and forecast a “modest impact” from Russia sanctions in the first half of the year.

The second quarter results, which J&J will report Wednesday, will show whether the company is meeting those expectations. They could also provide insights into evolving markets, such as the electrophysiology space that is being reshaped by the launches of pulsed field ablation (PFA) devices from Boston Scientific and Medtronic.

J&J reported electrophysiology growth of more than 20% in the U.S. and overseas in the first quarter. Tim Schmid, worldwide chairman of medtech at J&J, said the performance reflected the status of the company’s radiofrequency devices as the “most trusted and tested” products on the market. J&J has filed for authorization of a PFA device in the U.S. and could win approval around the end of 2024.

The company closed its $13.1 billion takeover of Shockwave Medical in late May. The earnings call could provide an early look at how the cardiovascular devices are performing as part of J&J and an update on the integration of Shockwave into the organization.

Because J&J has a broad business and posts results at the start of earnings season, analysts use the company’s results as a bellwether for other medtech businesses. BTIG analysts recently assessed whether J&J’s results predict the performance of other companies. The analysts found a strong link between J&J’s Advanced Surgery results and Intuitive’s procedure growth rate.

2. Abbott

Abbott’s second quarter results, which are slated for Thursday, will provide another look at how PFA devices are affecting manufacturers of traditional electrophysiology devices. The company's electrophysiology business brought in roughly $2.2 billion in 2023, but its PFA device is still in development.

So far, Abbott has outperformed analyst expectations in electrophysiology “as its technology continues to be used in mapping PFA cases and for [radiofrequency] ablation,” BTIG analysts said in a research note. However, PFA competition informed the analysts’ decision to forecast lower Abbott medtech sales than its peers.

BTIG analysts said Abbott’s continuous glucose monitor (CGM) sales could benefit from a basal-only expansion and recent integrations into automated insulin delivery systems. The introduction of over-the-counter CGMs could fuel further growth but the analysts want to know how Abbott will price its product.

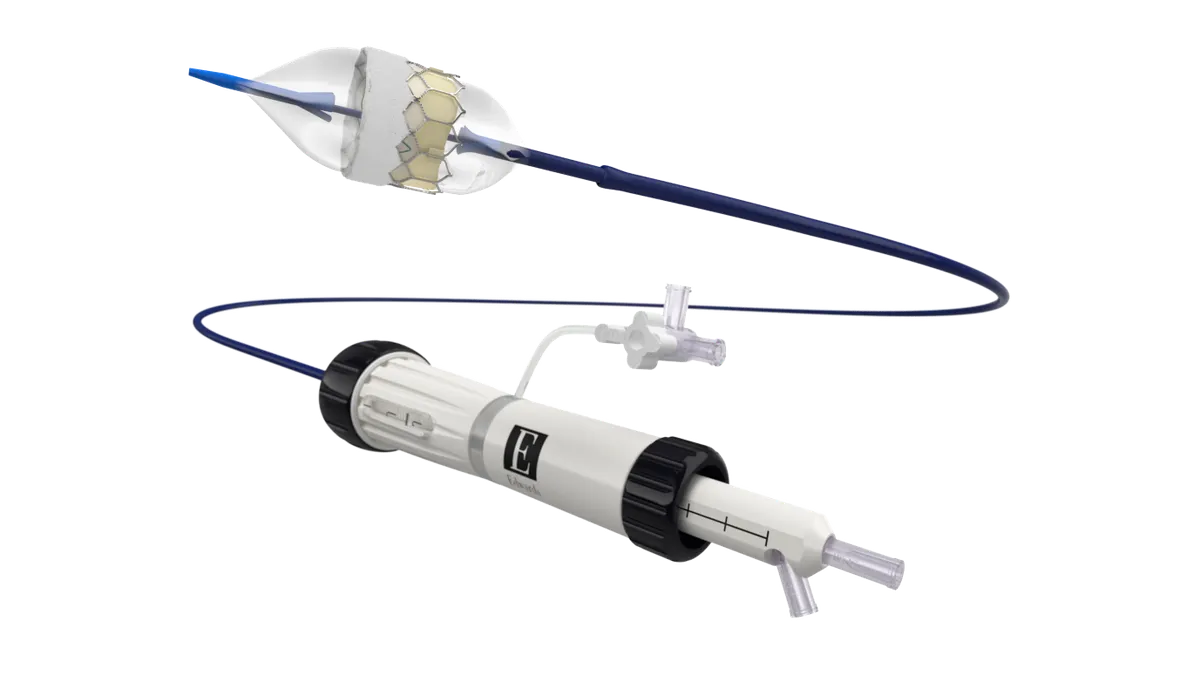

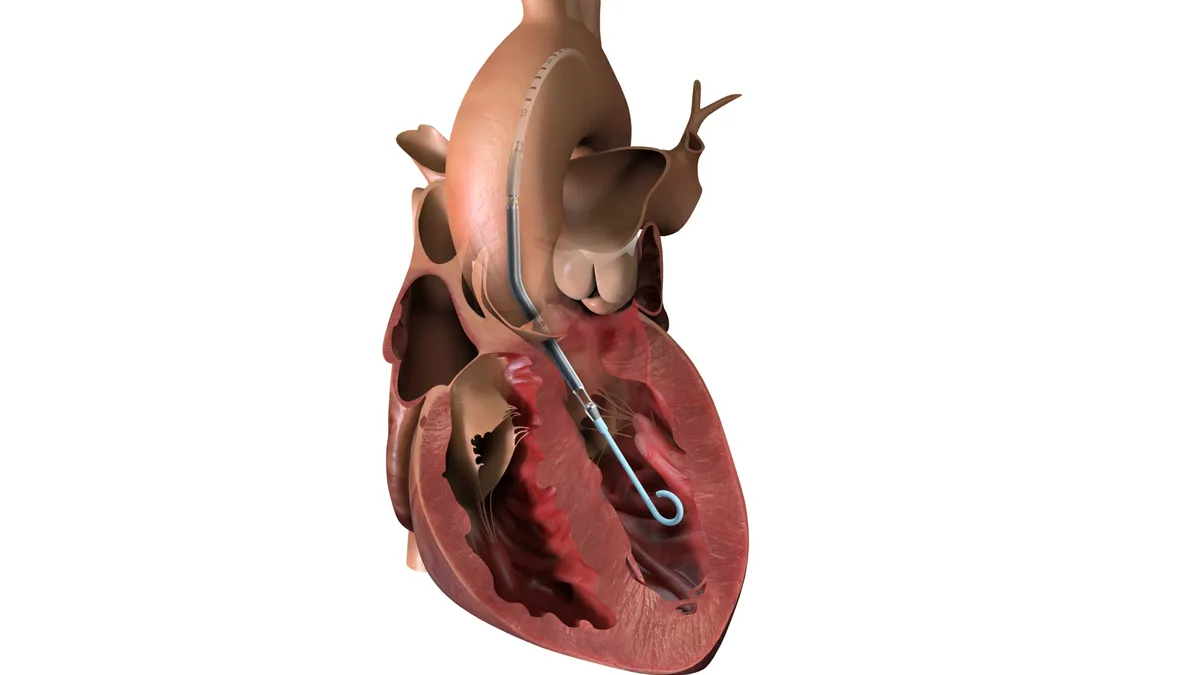

Other areas of focus include the launches of the Aveir DR dual-chamber leadless pacemaker and Triclip for tricuspid regurgitation, as well as the introduction of a recently cleared bedside concussion test.

3. Intuitive Surgical

Intuitive will wrap up the first week of medtech earnings season when it reports results after the market closes on Thursday. The results will show how the launch of Intuitive’s latest surgical robot, da Vinci 5, is progressing. J.P. Morgan analysts said around 30 placements in the second quarter is the “sweet spot.”

BTIG analysts counted 23 different hospitals with the new system in a recent analysis of social media posts. However, the analysts subsequently saw social media posts that suggested around 100 da Vinci 5 systems are already in the field. The BTIG team said the figure “seems aggressive” but many investors may now expect to see an installed base of around 100 systems.

Procedure growth is the other area of focus. J.P. Morgan analysts expect factors that could slow growth, such as reduced demand for bariatric surgery and the situation in China, to have minimal impact.

“We think, if anything, the environment has improved modestly in China barring competitive headwinds, and while bariatric surgery should continue to remain pressured, given the low to mid-single digit % of procedures, we aren’t overly concerned,” the analysts said.

The J.P. Morgan analysts expect procedure growth to stay in the 15% to 16% range in the second quarter.