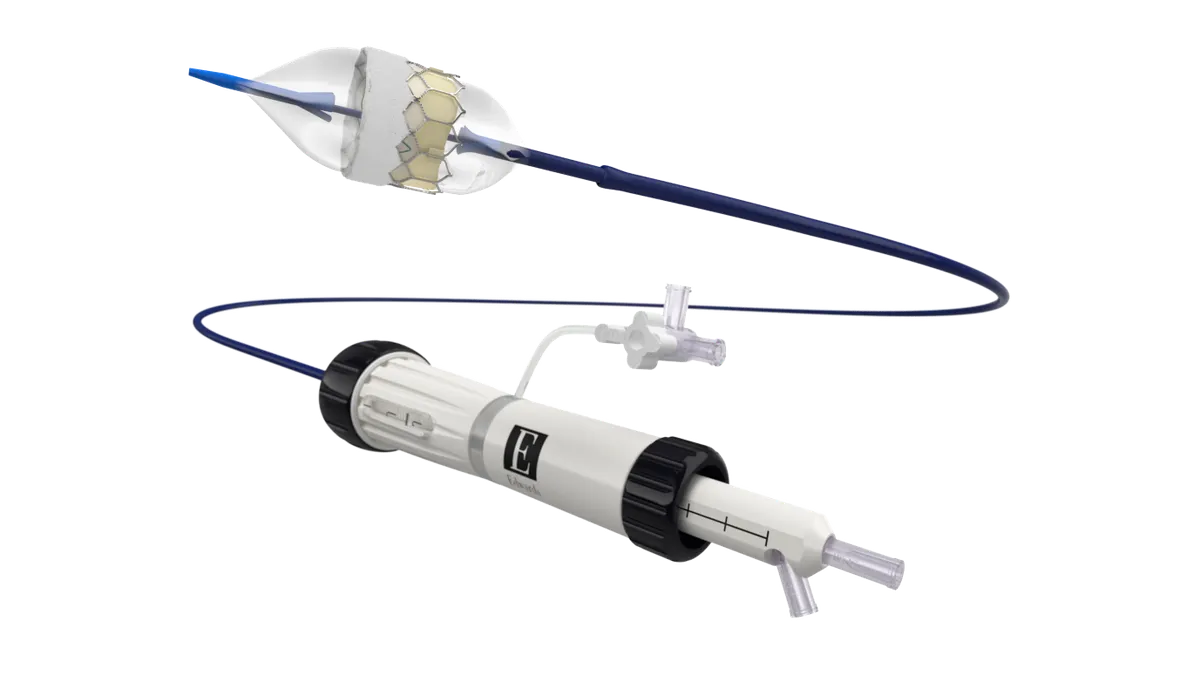

Johnson & Johnson received a CE mark in November for Ethizia, a hemostatic sealing patch designed to stop bleeding in internal organs. The product, which the Food and Drug Administration has not yet approved, will add to J&J’s biosurgery segment, a contributor to the growth of its medtech portfolio.

In 2023, J&J reported 3.6% year-over-year growth in the company’s $10.04 billion surgery segment, driven by the strength of its biosurgery and wound closure portfolios.

Nisha Johnson, J&J Medtech’s global president of biosurgery and wound closure & healing, spoke with MedTech Dive about the Ethizia launch and the broader market for wound closure.

This interview has been edited for length and clarity.

MEDTECH DIVE: What’s the significance of the launch for the Ethizia wound closure product?

NISHA JOHNSON: The burden of bleeding is a really important area for us. We’ve been market leaders in this space for a very long time. The process of stopping bleeding during the operation and ensuring that no bleeding occurs after the patient has been closed up and goes into recovery in the ward or goes home is really important.

If bleeding occurs, that can significantly impede the progress that a surgeon can make on the steps of a surgical procedure.

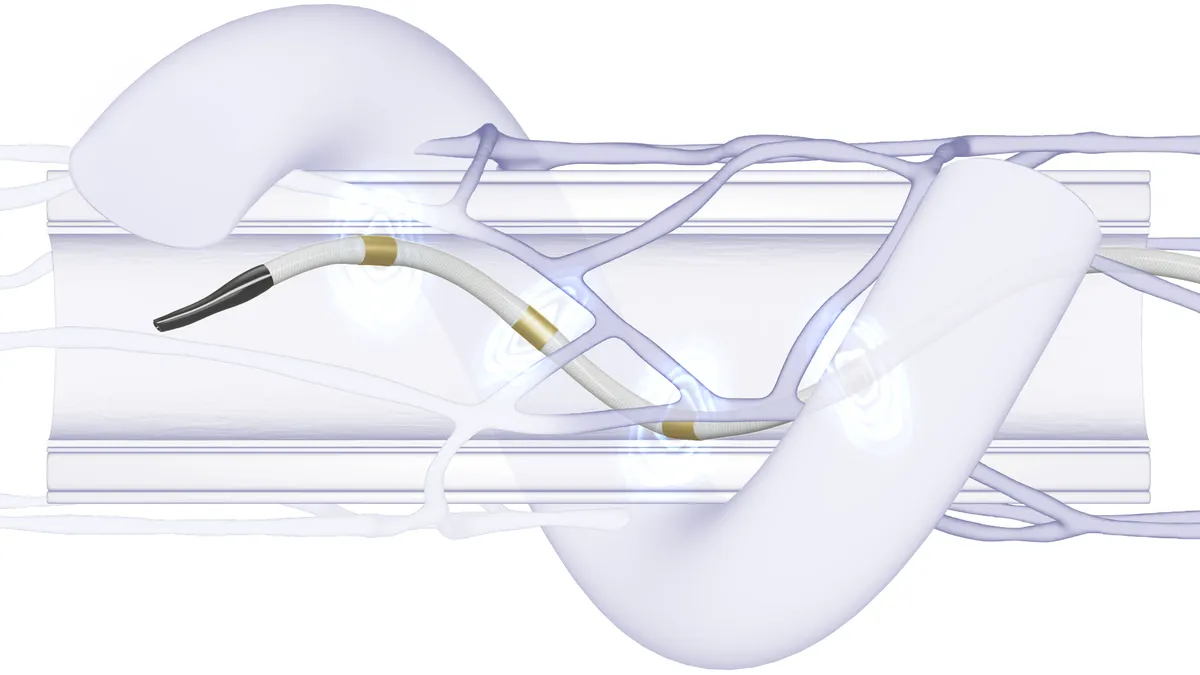

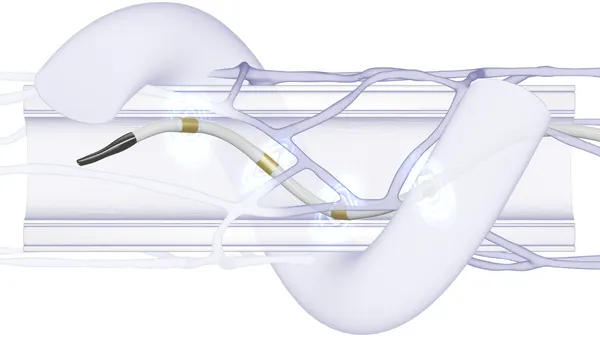

Ethizia falls into this really important area of unmet need, which is the problematic bleeding space. The device enables a surgeon to address bleeding very quickly intraoperatively with a lot of competence, and they'll be able to solve that bleeding challenge and move on.

Twenty-five percent of surgeries end in a complication relating to bleeding, so being able to help solve some of these challenges in Europe first of all is fantastic.

Do you have plans to bring this technology to the U.S. as well?

For now, we’re focused on the Europe, Middle East and Africa regions. As we gain more understanding and learning, we'll be looking at more expansion in the future.

How does this fit into your biosurgery portfolio?

We are really excited about completing the portfolio because fewer than 40% of surgeries that could use a hemostat today are able to. Part of our job is educating around the need for hemostasis products for biosurgery, and educating around these bleeding domains very effectively so that surgeons understand what technologies are available to them and can pick what's most appropriate for them in each bleeding scenario.

What’s the global market for biosurgery products?

It’s growing between 5% and 7%, that’s the compound annual growth rate from ‘22 to ‘27. It’s a good position for us to be in. We’ve got 17 consecutive quarters of gaining or maintaining share, which we’re obviously very pleased with.

Why is the market for this technology underpenetrated?

Patients are becoming more complex. We still see a significant number of patients having complications in healing and bleeding post surgery, and that can be due to all kinds of things — comorbidities like diabetes and peripheral cardiovascular disease; the use of aspirin, heparin, beta blockers. All of these medications also have an impact on what happens to the patient and what their coagulation mechanism looks like on the operating table. So it's increasing the complexity of what happens to a patient in the OR. That's why these products are so needed and why advancing in technology is going to be so fundamental to surgeons in the future.

You shared closing wounds in the liver as an example. What other indications can this product be used on?

At the moment, our CE mark is for soft tissue. There's a significant need in hepatobiliary surgery, which is where liver surgery falls. It's a really important area for surgeons to discuss with us as they think about where problematic bleeding occurs and where this technology would be most applicable.

Because the device is easy to handle — it’s very pliable… you can stuff it, roll it, pull it apart, use smaller amounts or bigger amounts and lay it on top of each other, and it’s bioabsorbable within 4 to 6 weeks — there’s a lot of flexibility in the way the product can be used or applied. That’s something that isn't necessarily true of other products in the market.

What does the new device mean for patient outcomes?

As patients are coming out of the operating room, surgeons want to be very confident that they've dealt with any postoperative bleeding that might occur. The worst outcome would be to have to go back in and check if bleeding was happening. A lot of patients end up with a drain, or they're monitored for postoperative fluid drainage.

That's what this helps us to avoid. Those bleeding challenges are being addressed intraoperatively with very effective products. It can also help us to avoid, in some cases, the need for a transfusion intraoperatively, which is, again, a big advantage to the healing of patients.