Dive Brief:

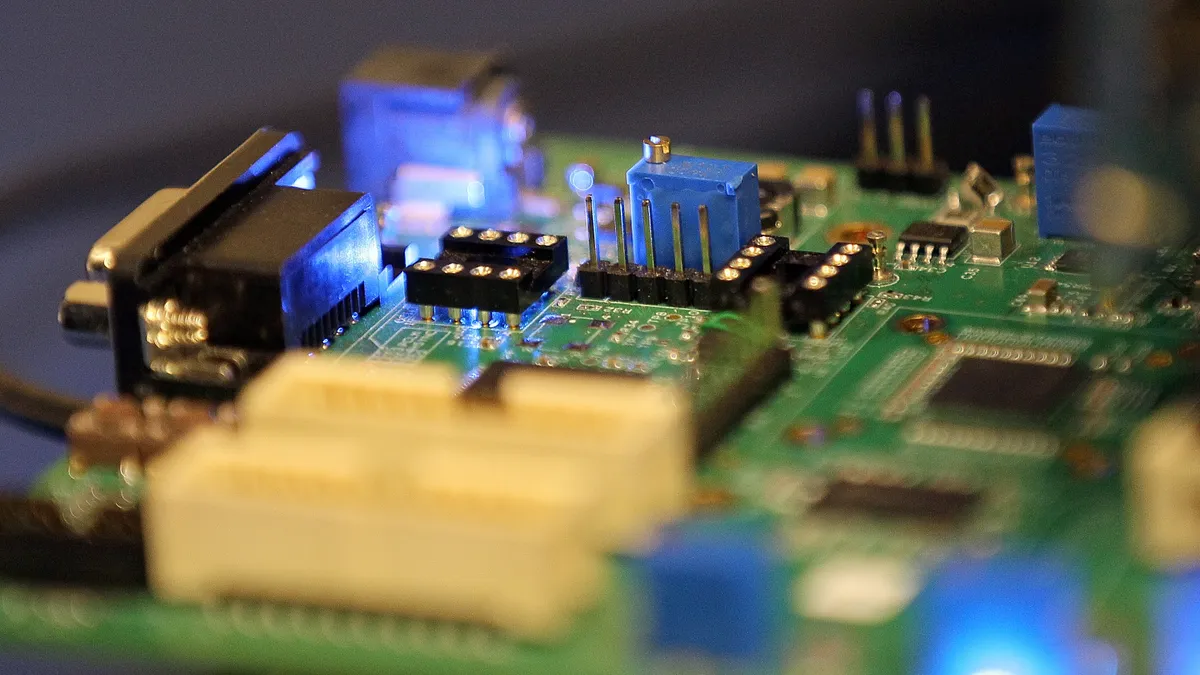

- MedTech Europe has called for political action to stop “a growing divergence” of semiconductor supply and demand from harming patients.

- The trade group wants European authorities to prioritize the allocation of “mature and advanced semiconductors” to the healthcare sector and give device manufacturers the flexibility to quickly “incorporate varying semiconductor types” under the new medtech regulations.

- MedTech Europe’s statement coincided with progress in the U.S., where a bill intended to make the country less reliant on China for semiconductors passed a procedural vote in the Senate. A final vote on the bill is planned for this week.

Dive Insight:

MedTech Europe has been quieter than its counterpart in the U.S., AdvaMed, about the impact of the global semiconductor shortage on the industry it represents. The trade group welcomed the publication of the European Chips Act earlier this year but has otherwise focused its lobbying on the impact of the new regulations on the supply of medical devices and in vitro diagnostics.

That changed on Tuesday when MedTech Europe published a call for action, arguing that “immediate global and European actions are needed to safeguard against harm to patients and healthcare systems stemming from the semiconductor shortage.”

Specifically, the trade group wants to see: prioritized allocation of semiconductors to healthcare, now and in the future; transparency in chip allocation; greater regulatory flexibility to incorporate “varying semiconductor types” swiftly; and incentives to increase semiconductor production and allow end-users to re-design medical technologies to use newer generations of semiconductors.

The requests reflect the problems identified by MedTech Europe. According to the trade group, medtech companies have partially compensated for the chip shortage by using up stockpiles, working with brokers and otherwise changing their practices. On the downside, that’s raised costs and lead times, making it hard to predict when devices will be ready for use, and MedTech Europe wants to see longer-term fixes.

Manufacturers have tried to replace or reengineer components to switch to alternative chips, the trade group said, but that “is not straightforward to do quickly, as it triggers the need for validation of the new semiconductors, which could trigger regulatory consequences.” MedTech Europe wants companies to be able to change semiconductors without requiring recertification under the new regulations if the switch “has no negative impact on the device’s safety, performance or benefit-risk ratio.”

The trade group is also calling for public financing of semiconductor production “to ensure critical sectors like medical technologies can be prioritized during shortages, for example providing premiums for semiconductor manufacturers that supply to critical industries.” Increasing production in Europe is another goal.

Those requests overlap with the approach taken in the U.S., where the Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS) cleared a procedural vote in the Senate on Tuesday. The CHIPS bill will provide $54 billion in grants for semiconductor manufacturing and research, plus support for regional technology hubs and a 25% tax credit on investments in semiconductor production until 2026.

That bill is set for a final vote this week. At least 11 Republicans will need to vote for the bill to get it over the line. If that happens, the bill will advance to the House, where it has bipartisan support.