Nevro is exploring strategic options including the sale of the business as part of an attempt to accelerate growth and diversify the product portfolio, the company said Tuesday.

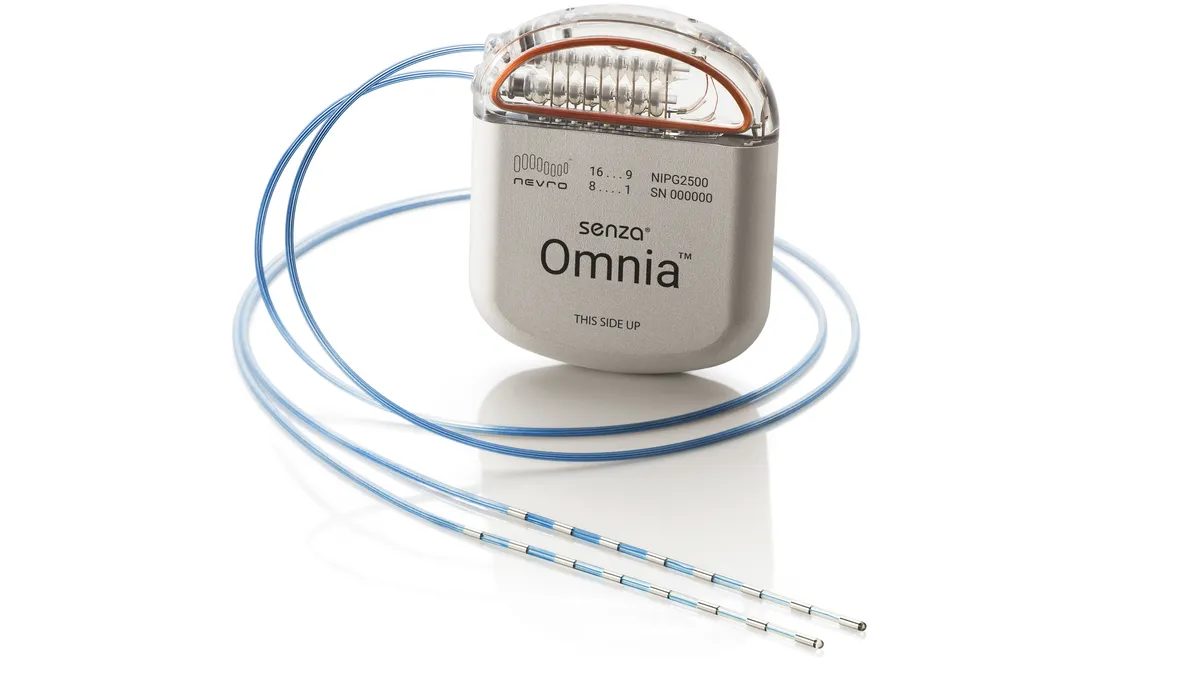

CEO Kevin Thornal said on an earnings call that “competitive dynamics and continued softness” in the U.S. spinal cord stimulation (SCS) market hurt Nevro’s sales in the second quarter. Nevro’s board hired Thornal in 2023 with a brief to address challenges in the SCS market.

One of Thornal’s strategies is to buy other companies to expand beyond SCS. Last year, Nevro bought Vyrsa Technologies, a company with a minimally invasive treatment for lower back pain.

“We really like our strategy of diversification that allows us to bring more value to our customers. And we could do that on a standalone basis,” Thornal told investors. “But we did feel the urgency to explore all possible options.”

Potential opportunities include “partnerships, mergers or even a sale of the company,” Thornal said. Nevro has not set a timeline for concluding the process, the CEO said, and may decide the best option is to remain a standalone company.

Analysts have discussed Nevro, a SCS-focused company that competes with Abbott, Boston Scientific and Medtronic, as a potential acquisition target for years. However, shifts in the SCS market have changed perceptions about the attractiveness of the company to buyers. Needham analysts recently removed Nevro from their list of the top 25 potential medtech acquisition targets due to its “modest growth rate.”

William Blair analysts commented on a potential sale in a note to investors. The analysts said “there is value” in Nevro from its brand and data in a potentially large market. However, “new competition, tepid market growth [and a] lack of profitability” might complicate Nevro’s pursuit of a deal and affect its valuation.

A transaction that further broadens Nevro’s portfolio beyond SCS could make the product more attractive to some healthcare providers, who Thornal said “find value partnering with companies that can offer a diverse portfolio of products that treat and diagnose a broader spectrum of the patients.”

Diversification could also make Nevro less vulnerable to changes in the SCS market. Thornal said Nevro is being affected by newer treatment options earlier in the care pathway that are “delaying patients from getting SCS therapy as well as competing for our customers' time and operating room schedules.” At the same time, Nevro is contending with increased competition for the SCS market.

Thornal said “two large competitors that had product launches over the last year” have affected Nevro. New SCS devices have historically performed well initially because some physicians “like to try the shiny new thing for a bit,” the CEO said, and because “there could be some pricing or other things that incentivize physicians to try those new products.”

The pressures contributed to a 9.5% reduction in U.S. trial procedures in the second quarter and Nevro’s decision to reduce its guidance for the full year. Nevro now expects worldwide revenue of $400 million to $405 million, down from its previous guidance range of $435 million to $445 million.

Nevro’s stock price fell 44% on Wednesday, closing at $4.83. Shares were up more than 15% Thursday morning.