Dive Brief:

- Pear Therapeutics has set out its approach to clinical data and market access as it seeks a more than fivefold increase in revenue for its prescription digital therapeutics in 2022.

- The Boston-based company used its virtual investor day to share clinical data and evidence on its products, including the results of a study published in Advances in Therapy on Monday. The study used real-world data to link Pear’s digital therapeutic for substance use disorder, reSET, to an estimated $3,591 reduction in per-patient costs.

- Pear also presented details of its reimbursement infrastructure. While analysts at BTIG said in a note that the company has built an ecosystem to adequately address payer questions, its shares fell 22% on the day of the investor event.

Dive Insight:

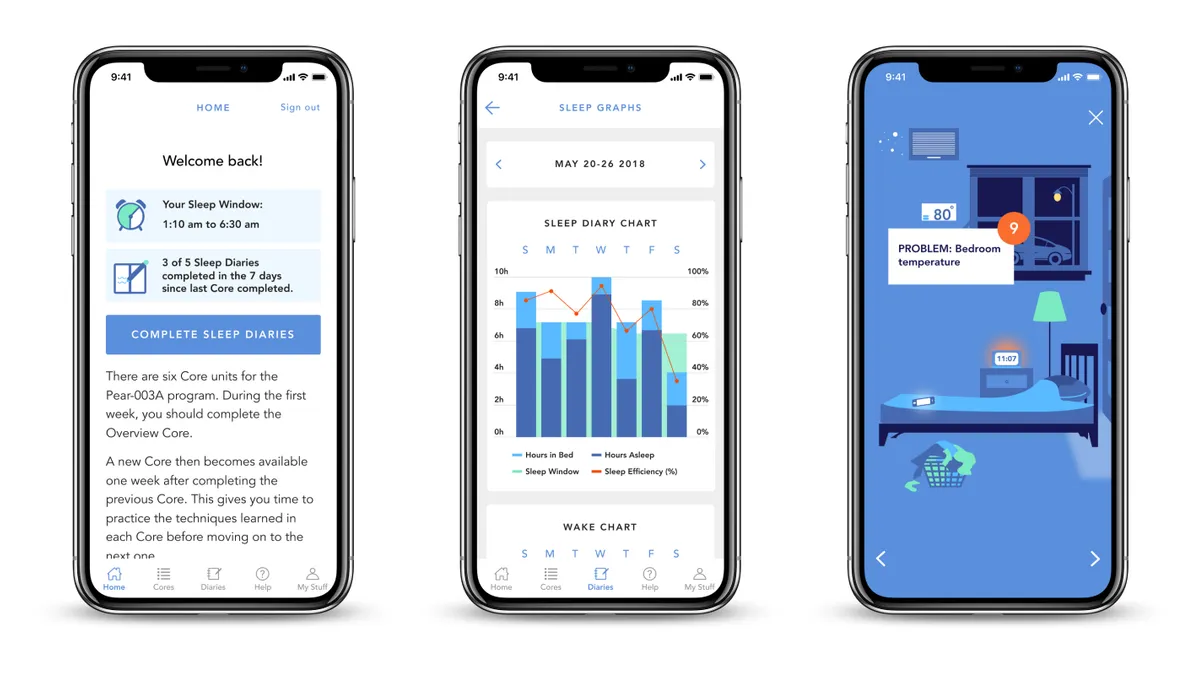

Pear ended last year with 14,000 prescriptions written for its addiction, opioid use disorder and insomnia digital therapeutics, above its forecast of 12,500. The goal for 2022 is to have 50,000 to 60,000 total prescriptions for the year. By expanding coverage, the company aims to increase its revenue from $4.2 million last year to $22 million this year.

Investors have cooled on the company and Pear's stock has dropped about 47% this year. Most of the stock-price decline on the investor day event occurred when the markets opened and before the start of the company' presentation.

At the event, Pear discussed data including the real-world study. The study evaluated insurance claims in the six months before and after 101 adults started treatment with reSET, though it didn't have a control group. In the period after starting to use reSET, overall hospital encounters fell 50%, reflecting declines in inpatient stays, partial hospitalizations and emergency department visits. The BTIG analysts expressed optimisim about the data.

“We view this as encouraging data that mirrors the cost savings that have been seen with other PEAR PDTs, and with the cost reduction more than covering the cost of the treatment, we believe it adds another compelling data point to the company’s conversations with payors,” the analysts wrote in a note to investors.

Pear also used the investor day to provide information about its conversations with payors. Mark Hopman, vice president of market access, compared the conversations to his experience at Dexcom in the early days of the continuous glucose monitor space. He noted that payers are being “very cautious” because prescription digital therapeutics are a new category and modality of treatment to them.

As Pear works to educate payers about prescription digital therapeutics, it's drawing on its successes of securing agreements with states including Michigan. Payers mention the same set of questions as they weigh whether to cover the products.

“Payers are really interested in asking three questions: First is, do patients use your product? Two, does your product save me money? And three, how does my organization implement coverage for these products?” Julia Strandberg, Pear's chief commercial officer, said at the investor day event.

Pear is seeking to answer the first two questions using data such as the real-world reSET findings. Regarding the implementation of coverage, Strandberg said Pear has “to meet the payers where they are,” for example by allowing “claims processing within their current infrastructure.”

Pear encourages reimbursement via pharmacy channels or access agreements, which have faster processing times, but also works with durable medical equipment suppliers when a medical benefit process is needed.

The BTIG analysts said has the infrastructure to address the three questions and have set a $12 share-price target for the company. The stock currently is trading at about $3.30.