Dive Brief:

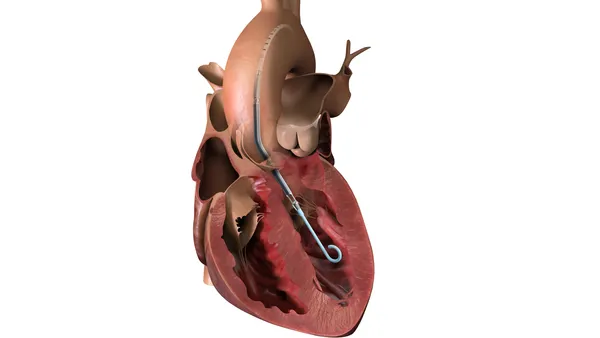

- Philips on Monday said it has set aside still more money to resolve its Respironics quality problems, while disclosing a U.S. Department of Justice subpoena the company and its subsidiaries received on April 8 seeking information about the recall.

- In Monday's first-quarter results, Philips said it took a 65 million euros (about $70 million) provision related to the repair and replacement of sleep apnea devices and ventilators and an approximately $107 million provision tied to possible higher costs of executing its program. The extra costs caused Philips' earnings to miss the consensus estimate. The latest provisions are on top of the aside 725 million euros set aside last year, which was equal to about $825 million at the time of the announcement.

- Updates on the recall, which included news of a delay to the timeline, overshadowed sales that came in slightly ahead of the analyst consensus, causing shares in Philips to fall nearly 12% when the market opened Monday.

Dive Insight:

Philips’ quality problems have snowballed since it disclosed issues with its sound abatement foam last year, with the size and cost of the original repair and replace program growing and amid a clutch of other Class I recalls. The topic again dominated Philips quarterly results and overshadowed any positives, as analysts at Jefferies set out in a note to investors.

"Whilst sales were slightly ahead of cons, we expect the focus to be on profitability, increasing provisions for the sleep care issue and delayed repair/replace completion date. [Philips] took another €215m for the field action provision to include higher potential execution costs and remediation costs," the analysts wrote in a note to investors.

Other negatives included a shift in the timeline for completing the fixes because of the identification of an additional 300,000 units for remediation. Philips now expects to complete 90% of the production and shipment to customers this year, having previously said it would wrap up the work in the fourth quarter.

Philips also disclosed the DOJ subpoena requesting "information related to events leading to the Respironics recall," which the company said it is cooperating with.

"We are not aware of any specific allegations. It's a subpoena for information, and that means they are preparing an investigation. We just have to accept that. It is not uncommon for a situation of this magnitude," Philips CEO Frans van Houten said on Monday's quarterly results conference call with investors.

The subpoena points to the potential for the impact of the quality problem to drag on long after Philips has repaired or replaced affected devices. As of March, Philips was subject to around 185 personal injury lawsuits and more than 100 class actions. Philips expects the class actions to be consolidated into two cases over the summer. The company also faces a security class action case, a lawsuit by SoClean and a set of cases outside the U.S.

Against that backdrop, Philips beat its forecast, with comparable sales falling 4% versus the expected high-single-digit drop. Philips' overall sales beat expectations despite the connected care unit performing worse than analysts expected. Comparable sales fell 21% as Philips contended with recalls and supply chain headwinds.

"We continue to face severe supply chain disruptions across our businesses, primarily related to the shortage of electronic components, increased shipping times and now again COVID affecting suppliers. We expect these headwinds to continue in the coming quarters," van Houten said. "Frankly speaking, I don't know what China is going to do. What will the consequences be on the global supply chain? We don't know. Clearly, the harbor in Shanghai needs to reopen and otherwise the whole world will suffer.”

The quarter was saved by 8% growth at the personal health business unit and double-digit growth in image-guided therapy, which limited the contraction of the supply-constrained diagnosis and treatment division to 2%. Philips pointed to the diagnosis and treatment business as a driver of the 5% increase in comparable order intake, while also warning that supply chain challenges could impact conversion of the backlog.

"It is important that we recognize the increasing risk related to the COVID-19 situation, to the Russia-Ukraine war, supply chain challenges and inflationary pressures, which may potentially impact our ability to convert our strong order book to sales and achieve our margin targets if conditions deteriorate further," van Houten said.

Philips kept its margin guidance amid the difficulties, but analysts are skeptical it can hit the top end.

"In our view, the top end of FY22 margin guidance is a best case. We calculate that the top end of 40-90bps guidance implies a near full recovery to pre-COVID levels which, in our view, is unlikely given the sleep care recall, F-483, escalating inflation, supply-chain headwinds, and execution issues," Jefferies analysts wrote.