Dive Brief:

- FDA’s updated regulatory framework to include software as a medical device (SaMD) should serve as a catalyst to spur increased industry innovation, according to a new report by Fitch Solutions Macro Research.

- The proposed framework will allow medical technology manufacturers to incorporate artificial intelligence and machine learning while providing for better monitoring of software from premarket development through post-market performance, Fitch said.

- The current regulatory framework hinders the ability of digital health companies to continuously improve the effectiveness and safety of their software products and respond quickly to bugs, adverse events and other problems, the report said.

Dive Insight:

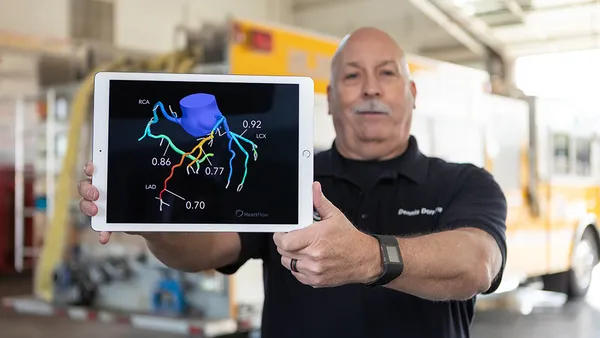

SaMD can range from software that permits a smartphone to view magnetic resonance imaging (MRI) images for diagnostic purposes to computer-aided software that performs image processing to help detect breast cancer. It does not include, for example, software in a medical device that controls the pumping of medication in an infusion pump or software used in closed-loop control in an implantable pacemaker.

Artificial intelligence and machine learning gather insight from data generated during delivery of everyday healthcare. Both have the potential to improve healthcare by facilitating earlier disease detection, more accurate diagnosis, more targeted therapies and improvements in personalized medicine, Fitch said.

Because software requires regular updating, FDA has been considering a total product lifecycle-based regulatory framework for these technologies that would allow for modifications to be made while ensuring safety and effectiveness.

Current AI technology authorized for marketing has "locked" algorithms without the ability to continually adapt when the algorithm is used. Locked algorithms are modified by the manufacturer at intervals. Machine learning algorithms that continually evolve do not need manual modification to incorporate learning or updates, Fitch said.

Healthcare technology companies have expanded their capabilities in these areas, the report said. The report pointed to examples including GE Healthcare’s Health Cloud to help manage the volume of healthcare data, Siemens Healthineers' Strategy 2025 focused on using data and AI to integrate technologies for therapy, and Hitachi’s partnership with Partners Connected Health to use AI to predict readmission rates for heart failure patients.

The entry of non-traditional healthcare companies in the sector will further drive adoption of big data and AI in the coming decades, Fitch said. Companies such as Dell, Google, Amazon, IBM Watson and Microsoft are likely to forge partnerships with existing suppliers or operate independently to create disruptive competition, the report said.

The new SaMD regulatory framework will remove barriers to manufacturers’ ability to modify new software, allowing for further diversification of product lines and likely long-term sales increases, Fitch said.