Dive Brief:

- The Securities and Exchange Commission has charged Surgalign Holdings, formerly RTI Surgical Holdings, and former executives Brian Hutchison and Robert Jordheim with accounting and disclosure fraud.

- According to the SEC, RTI shipped future orders ahead of schedule to pull forward revenues and thereby mask disappointing sales figures, all without disclosing the practice to investors.

- Surgalign has agreed to pay $2 million to settle the charges. Jordheim, the CFO of RTI until 2017, is paying a $75,000 civil penalty and has also agreed to return $206,831 to Surgalign.

Dive Insight:

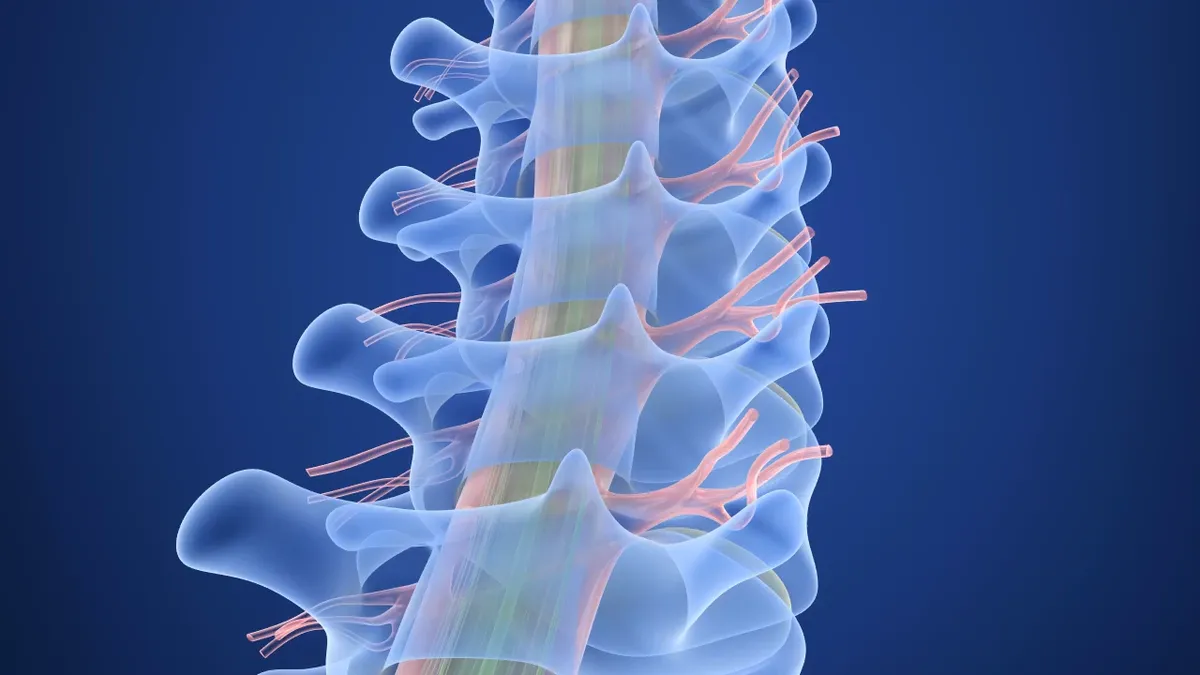

RTI sold surgical implants, such as orthopedic and spinal implants. The SEC accused RTI of shipping orders weeks or months before its customers originally requested delivery from 2015 to 2019. In some cases, RTI obtained permission from the customer to deliver early but in other cases it allegedly shipped early without prior consent.

According to the SEC, the company would have missed its quarterly revenue guidance from the first quarter of 2015 to the first quarter of 2016 without the use of early shipments to pull forward sales. RTI did miss its guidance in the third quarter of 2015 “because of a single large customer’s resistance to a pull-forward,” the SEC said.

The commission accused RTI of periodically using the practice from 2016 to 2019. Allegedly, members of RTI’s former senior management, including Jordheim, discussed opportunities for pull-forwards and asked the commercial division to identify opportunities.

“Jordheim and other former senior management approved discounts to induce customers to accept early shipments. Jordheim and other former senior management regularly received information about the volume of pull-forwards and their impact on RTI’s ability to achieve future revenue targets,” the SEC said. Employees expressed concerns but were allegedly overruled by RTI’s former senior management.

The SEC order focuses on Jordheim’s role but other former executives are implicated. Three other former RTI executives returned over $361,000 of incentive-based compensation to Surgalign. Hutchison, who was CEO of RTI until December 2016, is charged with violating anti-fraud and other provisions of the federal securities laws.

“This investigation and the settlement reached stems from the activities of RTI and former senior management, not our current team. Reaching this settlement with the SEC will allow us to move forward without this uncertainty,” Surgalign CFO David Lyle said in a statement.

Surgalign divested the RTI business, which was responsible for the violations, about two years ago, Lyle added. Surgalign said the company’s own internal investigation had revealed even more “conduct” that the SEC had not yet uncovered, and had shared that information with regulators. The company said it expected to recover from former executives a total of $600,000 in compensation related to the violations.