Dive Brief:

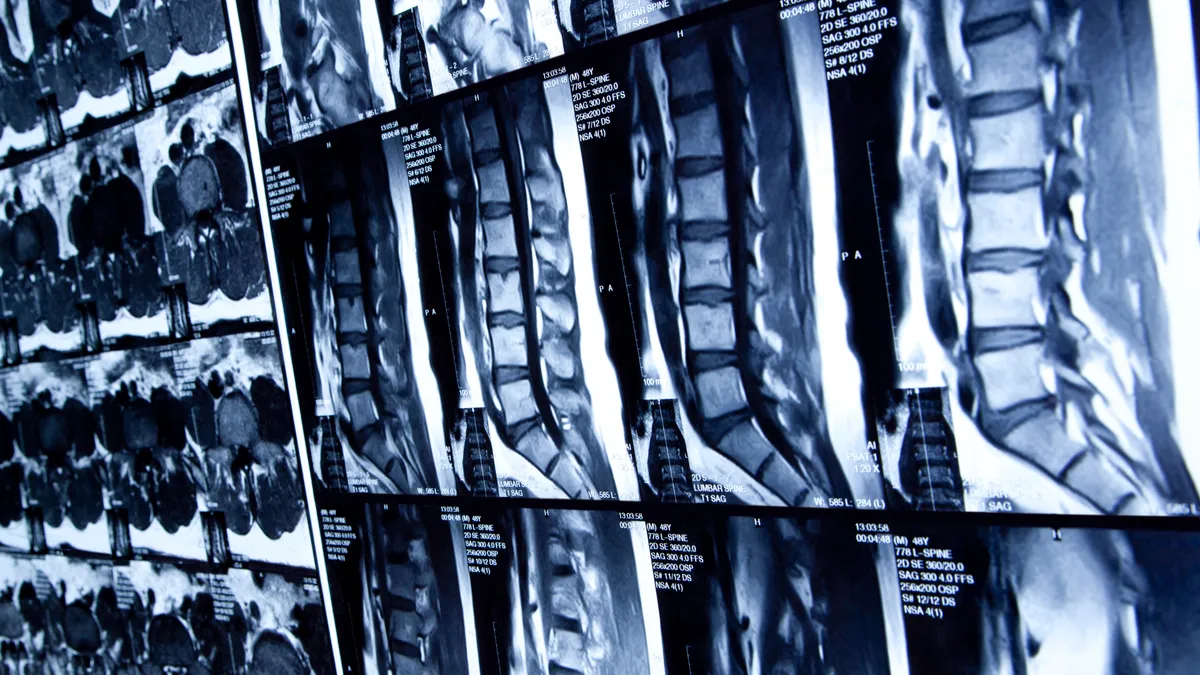

- U.S. spine surgeons expect procedure volumes to increase by 6.5% over the next year, suggesting companies such as Medtronic and Johnson & Johnson can grow above historical rates.

- BTIG analysts polled 50 physicians about the current spine market and their expectations for the future. The surgeons forecast 4.7% volume growth for the third quarter, and expect Globus Medical and Alphatec to win market share from larger rivals.

- Use of robotic systems in spine surgeries is increasing, climbing from 10% of procedures last year to 11% in the latest poll, and Medtronic’s Mazor X and Globus’ ExcelsiusGPS remain the favored platforms.

Dive Insight:

The BTIG analysts have polled neurosurgeons and spine-focused surgeons annually since 2019, creating a dataset that shows how the sector was affected by the COVID-19 pandemic and the changes it caused. The latest survey adds to existing evidence, notably from the quarterly results of orthopedic companies, of a recovery in the spine market.

BTIG found volumes increased 3.5% between the first and second quarters of 2023. A further 4.7% rise in volumes is forecast for the third quarter. The analysts calculated that respondents expect procedures to increase by 6.5% over the next 12 months.

While the finding suggests spine sales could exceed expectations in the upcoming quarter, the analysts note the limits of the sample size. Pricing was flat over the past year, and a 1.1% increase is forecast for the next 12 months.

Medtronic and J&J are the biggest players in the spine market, accounting for around 60% of the sector according to the analysts, and face competition from multiple rivals that have shares of 10% or less. Based on the survey, the BTIG analysts expect some shifts in market share over the coming year, with Globus and Alphatec forecast to gain ground at the expense of Medtronic, NuVasive and Stryker. Globus is trying to buy NuVasive, and has the support of both sets of shareholders, but has yet to close the deal.

Robotics is now part of the fight for market share. The latest survey found 11% of procedures are done robotically, a figure the respondents expect to rise to 20% over the next three years. Hospitals are buying multiple systems. Respondents had 2.7 systems, on average, in 2023. The number is forecast to increase to 4.7 over the next two years.

Asked which systems are likely to help spine device manufacturers win market share, the surgeons named Medtronic’s Mazor X and Globus’ ExcelsiusGPS as the leading robotic platforms. However, the analysts said “the gap between systems continues to tighten as robotics becomes more pervasive in the marketplace,” and they predicted that the rating will become closer with a variety of systems now available.