Q3 Insights: Stryker, a leading provider of orthopedic products, reported 7.7% sales growth in the third quarter amid the continued recovery of elective procedures. The company’s hip and knee franchises posted double-digit growth, as did its MedSurg and Neurotechnology units. Stryker would have grown faster but for the ongoing impact of hospital staffing shortages.

“While we are seeing volumes recover, hospital staffing pressures have continued to impact the ability to reduce procedural backlog in a meaningful way. These challenges will likely resolve gradually, and we continue to expect this will be a moderate tailwind into next year,” Stryker CEO Kevin Lobo said on the third-quarter results conference call.

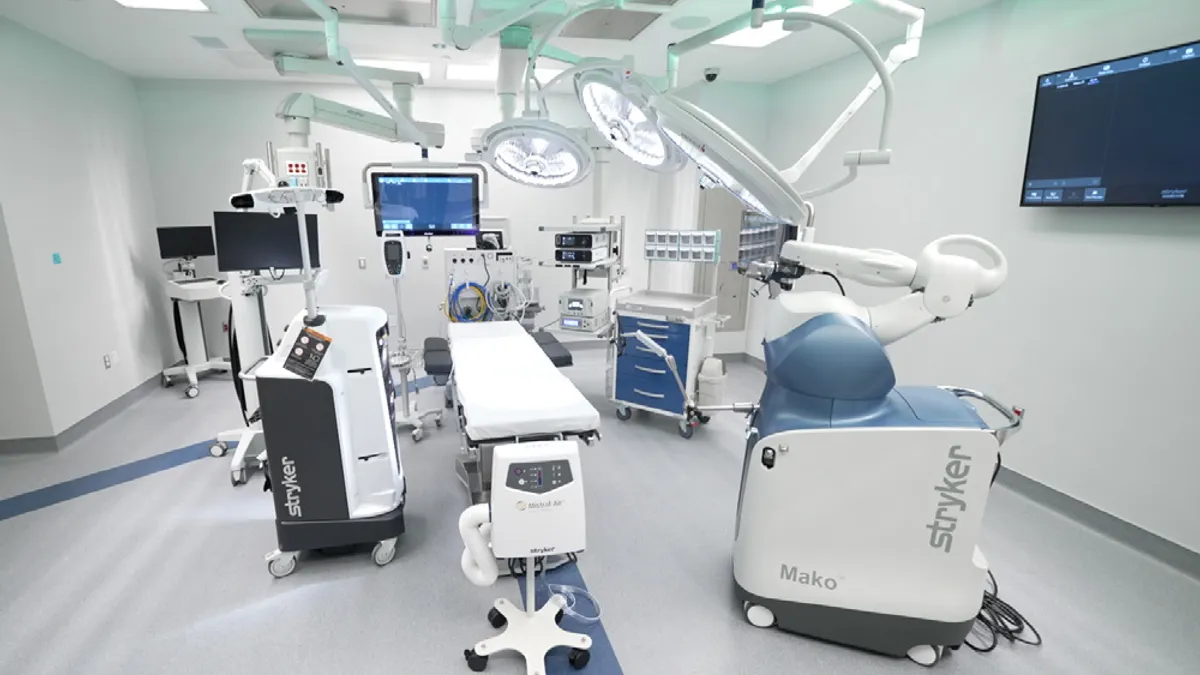

“Soft” Mako sales: Stryker faced specific challenges related to its Mako surgical robot, with Lobo noting that installations were “soft” because of “delays stemming from variability in the hospital environment.” Stryker expects the surgical robot to deliver “a good fourth quarter.” COVID-19-related hospital staffing shortages, particularly among nurses, have reduced the number of procedures carried out across the United States and around the world, reducing sales for nearly all medical device manufacturers.

The robotic division has been affected by Stryker’s efforts to control its costs. While noting that the R&D team is making good progress on spine and shoulder applications for Mako, Lobo revealed that Stryker has stopped the Cardan spine robotic project to focus its resources on its existing technology.

Delayed Vocera installations: Stryker shared an update on its integration of Vocera, which it acquired in a $2.97 billion takeover earlier this year. While stating that Stryker is “pleased” with the integration process, Jason Beach, VP of investor relations, noted some setbacks.

“In Q3, we elected to delay some installations shifting from on-prem servers to our cloud solution with certain customers. Also, as we do with all acquisitions, we are shifting the legacy sales force to the Stryker model, which has caused some disruption. These delays resulted in revenues that were essentially flat to Q3 2021,” Beach said.

Earnings forecast lowered: Stryker lowered its full-year adjusted EPS guidance to $9.15 to $9.25, down from $9.30 to $9.50 under its earlier outlook. The cut, which the company made despite narrowing its organic sales growth target at the top end of the prior range, reflects inflation and the anticipated impact of foreign currency exchange rates. Lobo expects negative foreign currency and inflationary pressures to continue “but at a more moderate level” for the rest of the year.

Shares in Stryker fell 4.84%, or $11.10, to $218 in premarket trading on the New York Stock Exchange.