Orthopedics competitors Stryker and Zimmer Biomet outlined two different approaches to growth in their latest earnings updates.

Stryker CEO Kevin Lobo highlighted the company’s recent acquisitions on a Tuesday earnings call. Stryker has bought a total of seven companies so far this year and expects they will contribute $300 million to its sales in 2025, the CEO said.

Recent purchases include Care.AI, Nico Corporation and Vertos Medical. Care.AI makes virtual workflows for hospitals, Nico manufactures tools for brain tumor removal and stroke care, and Vertos makes a treatment for chronic lower back pain.

The acquisitions are small, for the most part, but “very exciting for each of those individual businesses,” Lobo said.

He added that Stryker still has “significant financial capacity” for future deals, having already spent $1.6 billion, and that M&A will be “the number one use of our cash going forward.”

Stryker has used its capital in the past for acquisitions, doing more than 50 deals in the last roughly 10 years, Wolfe Research analysts wrote in an investor note on Tuesday.

Zimmer outlined a different approach in its earnings call on Wednesday morning. CEO Ivan Tornos said the company continues to evaluate potential acquisitions, but “there is not a single deal that has jumped on us as saying we have to reallocate capital and do this deal immediately.”

Tornos added that Zimmer does not need to make an acquisition to keep its pace of growth, but would like to when it makes sense “strategically and financially.”

Robot update

Stryker had record installations of its Mako surgical robot in the quarter, Lobo said, although he did not disclose a specific figure.

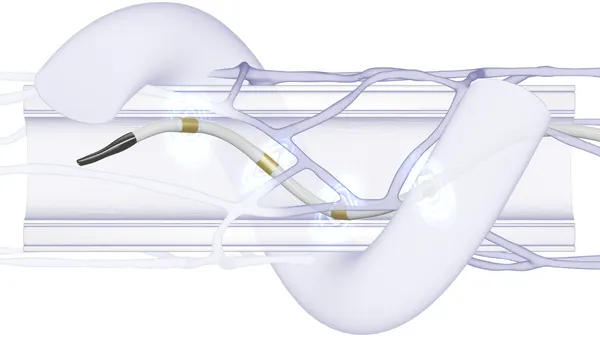

The company began early cases with its Mako spine robot, its newest spine guidance software and a feature called Copilot, which stops drilling automatically when it reaches the planned depth. Jason Beach, vice president of finance investor relations, said the spine robot features will be on a limited market release as the company refines training protocols.

Beach added that the company is on track to launch a shoulder feature for its surgical robot at the end of the year.

Zimmer’s Tornos provided an update on the company’s robotic-assisted shoulder replacement feature, saying the company has now done hundreds of cases in a limited market release, and has received feedback from surgeons that it can cut operating time meaningfully.

Tornos expects Rosa shoulder to be one of the company’s major growth drivers in late 2025 and 2026.

The company also provided an update on its “smart” knee implant, Persona IQ, which can capture information about patients’ range of motion and gait after surgery. With the recent launch of a version with a shorter stem, the company hopes to see meaningful adoption in the next two years. Developer Canary Medical received the Food and Drug Administration’s 510(k) clearance for the shorter stem in April.

Zimmer challenged by new ERP system

Tornos said Zimmer is working through challenges stemming from a switch to new enterprise resource management software.

The company switched to a new distribution system for North America in the third quarter, which resulted in slower shipping of products to customers, CFO Suky Upadhyay told investors. Specifically, the company switched from its legacy ERP system to one made by SAP, which created a disruption in August, RBC Capital Markets analyst Shagun Singh wrote in a September research note.

The problem was expected to affect all of Zimmer’s segments, particularly its sports, extremity and trauma business, and its “other” business, which includes sales of the Rosa surgical robot.

Zimmer mitigated the impact and expects to be back to normal service levels at the end of 2024, Upadhyay said.