New products:

Despite swinging to a loss of $94.6 million for the year, Tandem Diabetes Care said it expects growth in 2023, fueled by new product launches of its own and by makers of continuous glucose monitors. The company did not include any impact from new devices in its financial forecast for 2023.

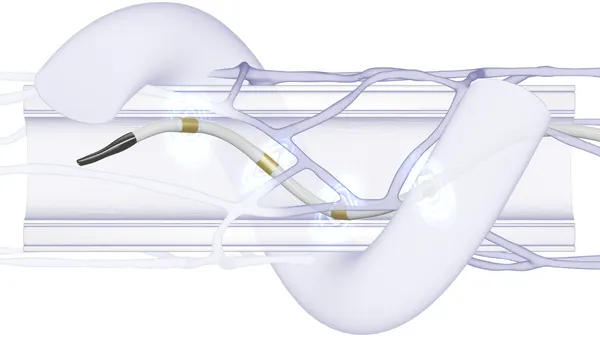

The San Diego, Calif.-based maker of insulin pumps has been working on a smaller device, named Mobi, which users can control with a smartphone. “Clearance timing remains difficult to predict,” CEO John Sheridan said on a Wednesday investor call announcing fourth-quarter earnings, adding that the company is preparing for a scaled launch in the second half of 2023.

Tandem is responding to the FDA’s questions about the device, but those communications are “normal for the state of the process,” said Sheridan.

Shares in Tandem fell 6%, or $2.40, to $37.65 in late morning trading on Thursday.

Separately, the company expects a boost from new continuous glucose monitors being introduced by Dexcom and Abbott Laboratories, and which can connect with Tandems pumps. “It’s a much better product,” Sheridan said of Dexcom’s G7. “We think it’s going to definitely be a favorable effect on [our] sales.”

Tandem expects integration with G7 in the second quarter, while integration with Abbott’s Freestyle Libre 3 will depend on when Abbott receives approval for automated insulin delivery, Craig Hallum analysts wrote in an emailed research note on Thursday.

Tandem forecasts 2023 sales of $885 million to $900 million, an increase of 10% to 12%. It expects an adjusted gross margin of about 52%. CFO Leigh Vosseller said that pricing improvements and cost efficiencies could offset product mix pressures, “but the real benefit is to come in the future from new product launches.”

Q4 trends:

The past year was a tough one for Tandem, the Craig Hallum analysts wrote. The company’s revenue increased by 14% in 2022, after five years of rapid growth, they noted, but they expressed concern over the 9% decrease in new pump growth in the U.S. over the past year.

“The stock has understandably been punished for this declining sales growth and the last several quarters of earnings misses have shaken investor confidence,” they wrote. “Q4 was a bit more of a ‘boring’ quarter, which we think investors will partially welcome.”

Tandem’s worldwide installed base increased by 29% in 2022 to about 420,000 customers, while pump shipments were flat year-over-year, which Vosseller said was due to variation and timing of orders from distributors.

About half of the company’s customers used insulin pumps for the first time, while the other half converted from competitors’ pumps.

“Our focus will be on continuing to expand the large and growing insulin pump market, which remains just over 35% penetrated in the U.S., and typically only 10% to 20% In the geographies we serve outside the United States,” Sheridan said.

New board chair:

Tandem also appointed a new chair to its board of directors. Rebecca Robertson, who joined as an independent director in 2019, was named chair of the board, succeeding Kim Blickenstaff, who will continue as a board member. Robertson is also a general partner at Versant Ventures, where she invests in medical devices and diagnostics.