The medtech earnings season continues this week with all eyes on whether Stryker, Boston Scientific and BD can add to the evidence of strong fundamentals seen in the first wave of results.

Johnson & Johnson, Intuitive Surgical and Abbott signaled a solid end to the year for markets across the medical device industry in reports last week. In response, RBC Capital Markets said in a research note that “positive sector fundamentals” were supported by trends in hospital outpatient, inpatient and ambulatory surgery center (ASC) settings.

Attention now turns to the next set of prints. Stryker will report on Tuesday afternoon, followed by Boston Scientific on Wednesday morning and BD on Thursday morning.

Here, MedTech Dive previews what to look out for in the second week of earnings for the industry:

1. Stryker

RBC analysts identified trends in outpatient and ASC settings as a good sign for Stryker and picked out J&J’s comments about the lack of change in the hip and knee markets as another positive. The analysts see Stryker as one of the “share takers” in the U.S. hip and knee markets in the quarter, after J&J reported growth for both segments. J&J’s spine and trauma results, plus Intuitive’s system placements, are other positive signs for Stryker, the analysts said.

Truist Securities analysts wrote in a research note they think investors are looking for Stryker to post another quarter of organic revenue out-performance, driving an earnings beat. Attention is also on the outlook for 2024, with the Truist team predicting Stryker will target an organic growth range of 6% to 8% or 7% to 9%. Both ranges cover the 7.9% consensus estimate of analysts quoted by Truist.

Away from the figures, the analysts expect management commentary on M&A to be the biggest area of focus. Many investors expect Stryker to do a deal this year, the analysts said, and want to know “how that will impact the company’s long-range margin trajectory.”

Trends in orthopedic volumes and backlog and hospital capital spending are other topics of investor interest.

2. Boston Scientific

Like Stryker, Boston Scientific is exposed to the positive outpatient and ASC trends, the RBC analysts told investors. RBC analysts also highlighted Abbott’s comments on transcatheter aortic valve replacement (TAVR), left atrial appendage closure devices and electrophysiology sales as positive for Boston Scientific. The one negative was increased competition from Abbott in the neuromodulation space, the analysts said.

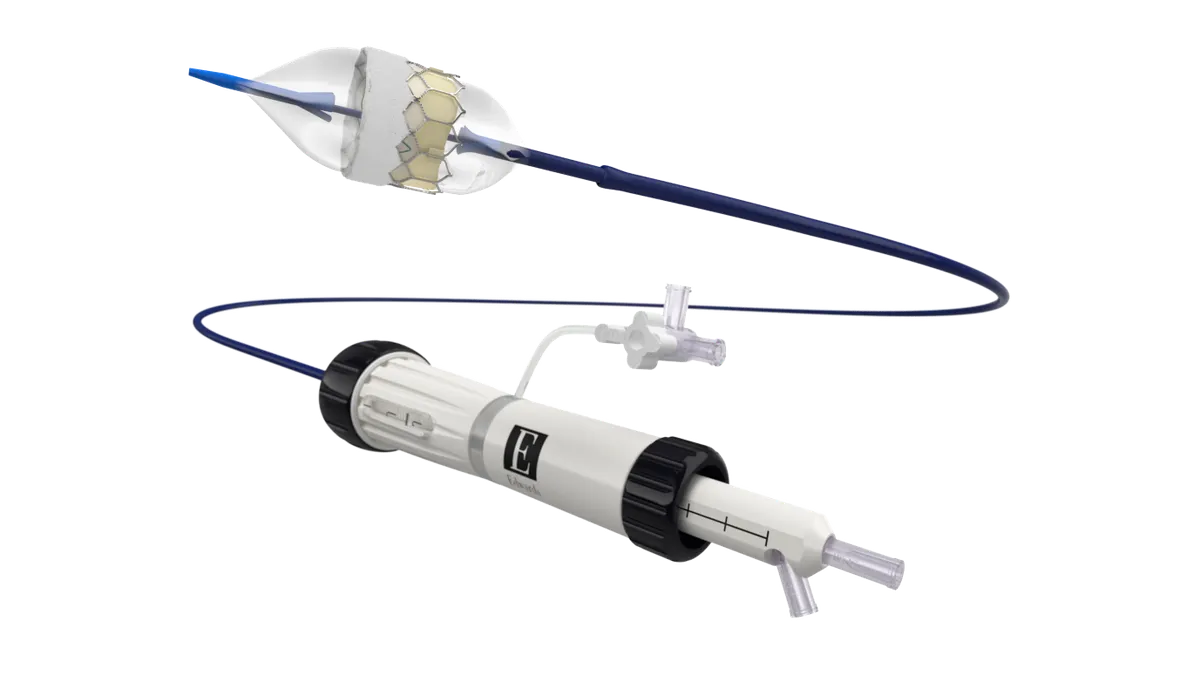

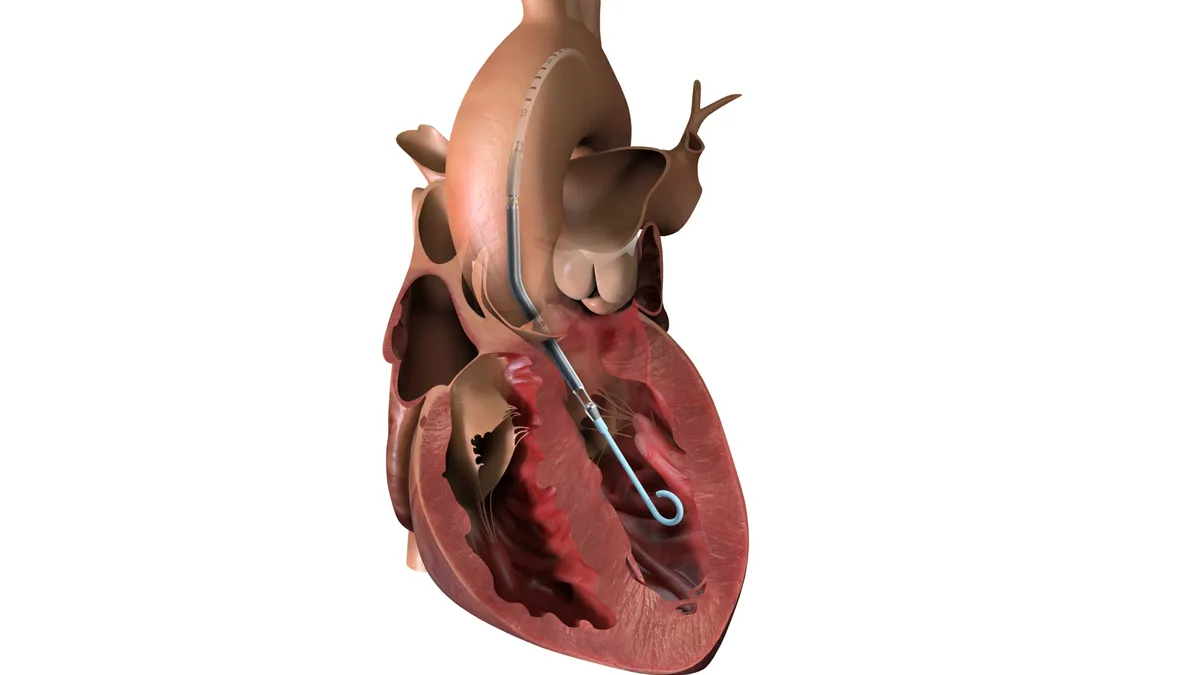

Truist analysts expect Boston Scientific to beat the consensus organic sales estimate. Looking forward, the analysts think the company will forecast at least 8% organic sales growth, in line with the consensus estimate, but see potential for it to go higher given the change in the anticipated timing of the approval of its pulsed field ablation device, Farapulse.

“In the past, [Boston Scientific] has guided conservatively, setting up to beat and raise and we would expect this to again be the case for 2024 as well,” Truist analysts wrote. “A slew of new product launches – Watchman Flx Pro, Acurate Neo TAVR, Farapulse in the U.S., Agent DCB Later in 2024 – should all contribute to accelerating momentum as the year progresses, particularly in 2H24.”

3. BD

Writing before the start of results season, J.P. Morgan analysts said BD “is positioned to outperform conservative expectations.” The company, which is reporting its first-quarter results this week, used the J.P. Morgan Healthcare Conference in San Francisco earlier this month to tell investors that “sales growth played out as expected” over the first three months of its financial year, with one exception.

BD CEO Thomas Polen told attendees that “approximately $30 million of flu testing revenue” has moved from the first quarter to the rest of the year. J.P. Morgan analysts said “the flu headwinds are more of a headline than an actual impairment of the underlying story” but cautioned that the year is “potentially starting off on the wrong foot.”

The analysts were unsure whether BD was “signaling a soft [first quarter] with the flu commentary” but said “it didn’t sound quite like the beats others preannounced.” The impact of the Alaris remediation is another area of uncertainty, with the analysts hearing contradictory comments from competitors about shifts in market share. BD believes share shifts were minimal during the last few years, the analysts said.

4. Danaher and Thermo Fisher Scientific

Danaher and Thermo Fisher Scientific also report this week. TD Cowen analysts predicted that Danaher will “likely” predict flat to low-single-digit growth in bioproduction for the coming year. The assessment was informed by the results of Sartorius, a provider of bioproduction tools.