M&A: Page 11

-

GE’s board finalizes healthcare spinoff

The new company, GE Healthcare, will be the sixth largest global medtech company when it starts trading on Nasdaq on Jan. 4.

By Elise Reuter • Dec. 1, 2022 -

Boston Scientific to buy Apollo Endosurgery for $615M as entry into endobariatric market

The acquisition values Apollo shares at two-thirds above their closing price Monday, and may herald a new trend in medtech M&A, says an analyst.

By Elise Reuter • Nov. 29, 2022 -

ResMed closes $1B Medifox buyout to expand software business into Europe

The takeover gives ResMed control of a 700-person operation that offers similar solutions to its existing U.S. brands MatrixCare and Brightree.

By Nick Paul Taylor • Nov. 23, 2022 -

Q&A

Friday Q&A: FemTech Focus’s Barreto discusses women’s health innovations, funding challenges

The executive director of the nonprofit group explains why women's health is finally getting attention and what the FemTech revolution is all about.

By Susan Kelly • Nov. 4, 2022 -

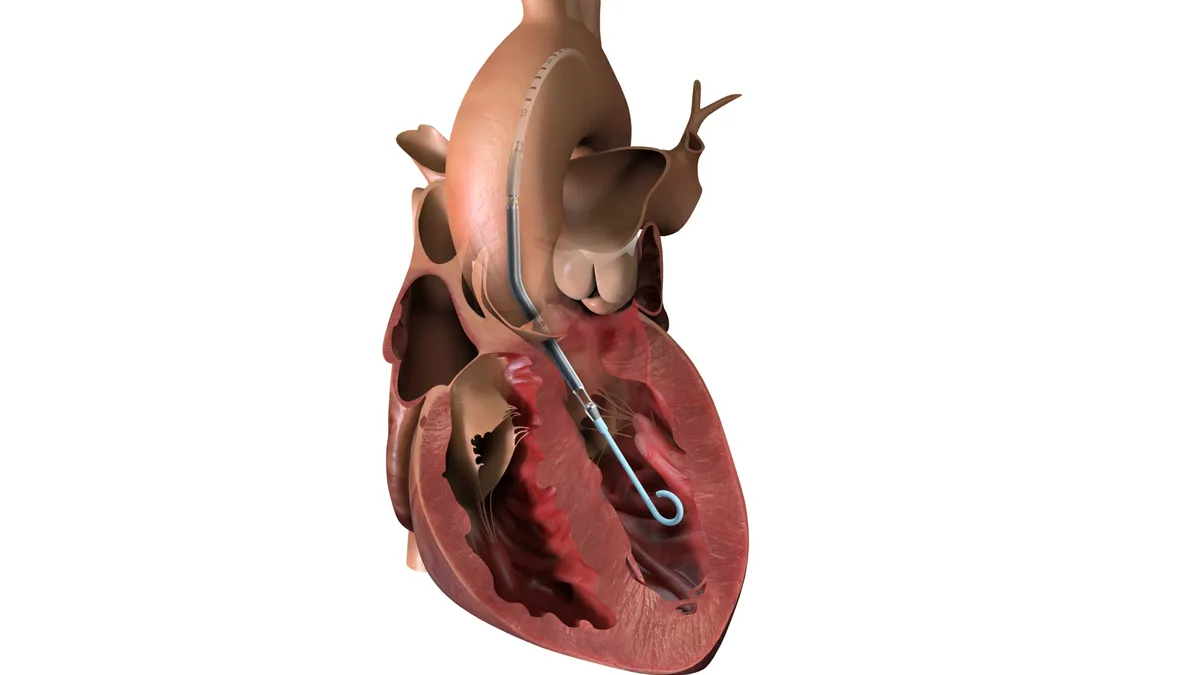

J&J to buy heart device maker Abiomed for $16.6B in year’s largest medtech deal

J&J will gain Abiomed’s heart pump devices amid a booming cardiac care market.

By Elise Reuter • Updated Nov. 2, 2022 -

Thermo Fisher will buy The Binding Site for $2.6B to gain specialty diagnostics portfolio

The U.K.-based firm makes two blood tests for multiple myeloma.

By Elise Reuter • Oct. 31, 2022 -

Medtech M&A decline poised to continue in 2023 amid ‘bumpy’ market: report

Dealmaking has dropped as companies grapple with surging inflation and decreased spending by hospitals, according to EY.

By Elise Reuter • Oct. 26, 2022 -

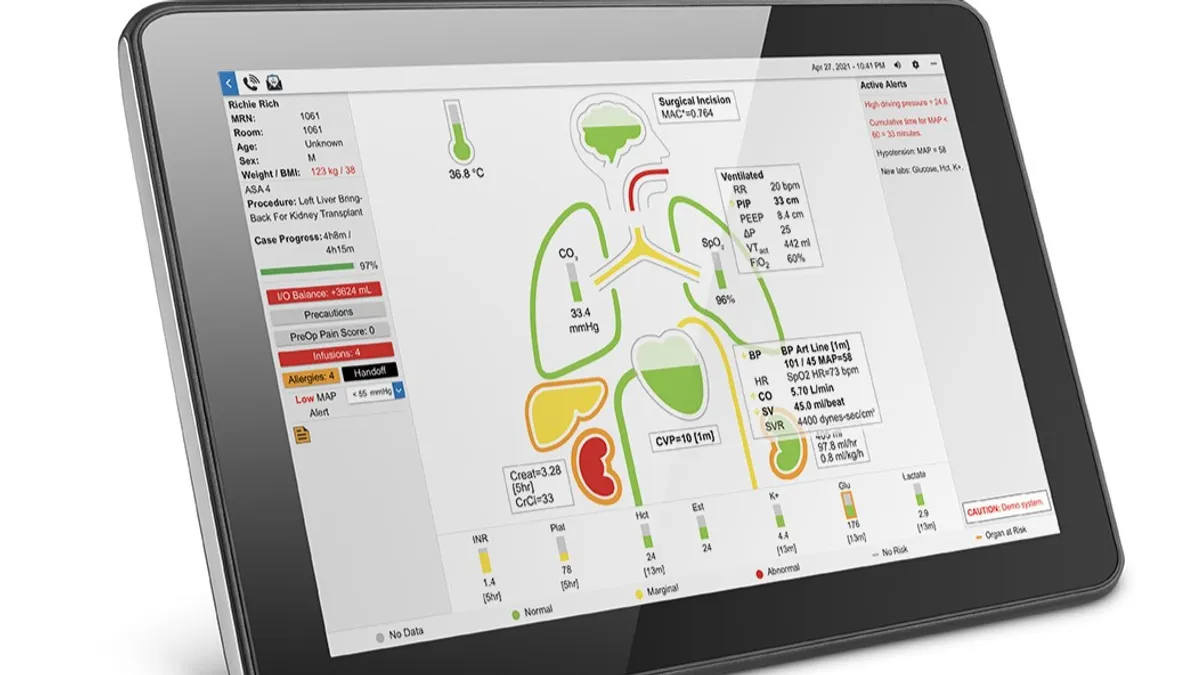

BioIntelliSense buys AlertWatch, expanding Medtronic patient monitoring partnership

Medtronic will distribute AlertWatch to hospitals in the U.S. alongside BioIntelliSense’s wearable device for continuous remote monitoring.

By Nick Paul Taylor • Oct. 25, 2022 -

Medtronic’s planned spinoff ‘doesn’t move the needle’ in growth strategy: analysts

Combining patient monitoring and respiratory intervention businesses into a separate company may not be enough to address investor concerns.

By Elise Reuter • Oct. 24, 2022 -

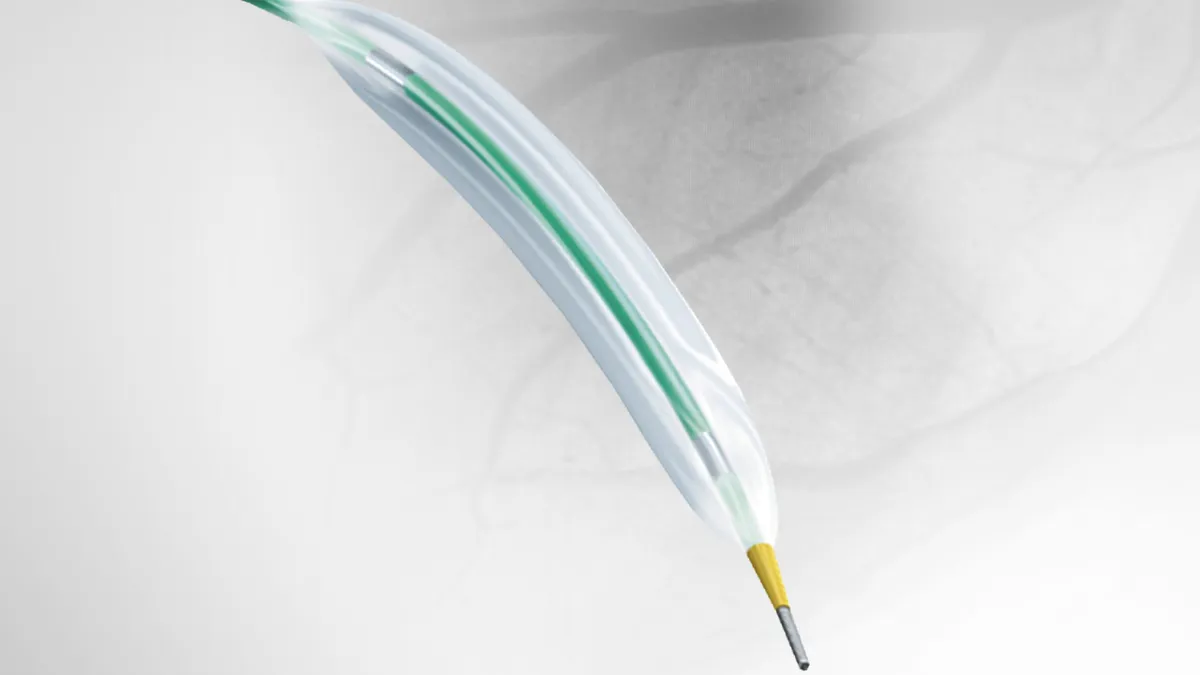

Cordis to spend $235M to buy Swiss maker of alternative to paclitaxel balloons

As regulatory and sales milestones are hit, Cordis could pay up to $900 million in total.

By Nick Paul Taylor • Oct. 19, 2022 -

Bio-Rad, Qiagen are in talks over $10B merger, WSJ reports

While the two companies have been in talks for some time, the deal may fall through, the report said, citing people familiar with the matter.

By Ricky Zipp • Updated Oct. 11, 2022 -

Teleflex completes acquisition of Standard Bariatrics amid slow year for medtech M&A

The $170 million transaction reflects the selective nature of industry activity.

By Peter Green , Elise Reuter • Sept. 29, 2022 -

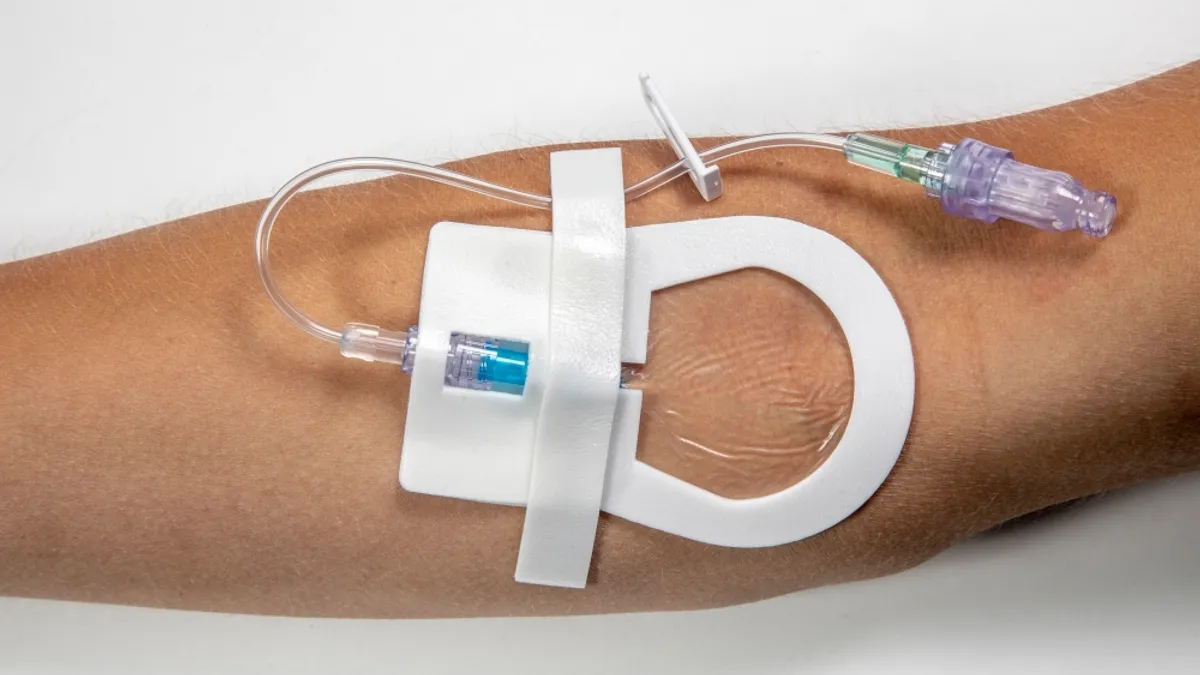

B. Braun acquires suite of catheter securement products from Starboard medical for undisclosed amount

The six acquired devices would improve patient care and extend B. Braun’s position in IV therapy, the company says.

By Elise Reuter • Sept. 28, 2022 -

Retrieved from Catheter Precision website on September 13, 2022

Retrieved from Catheter Precision website on September 13, 2022

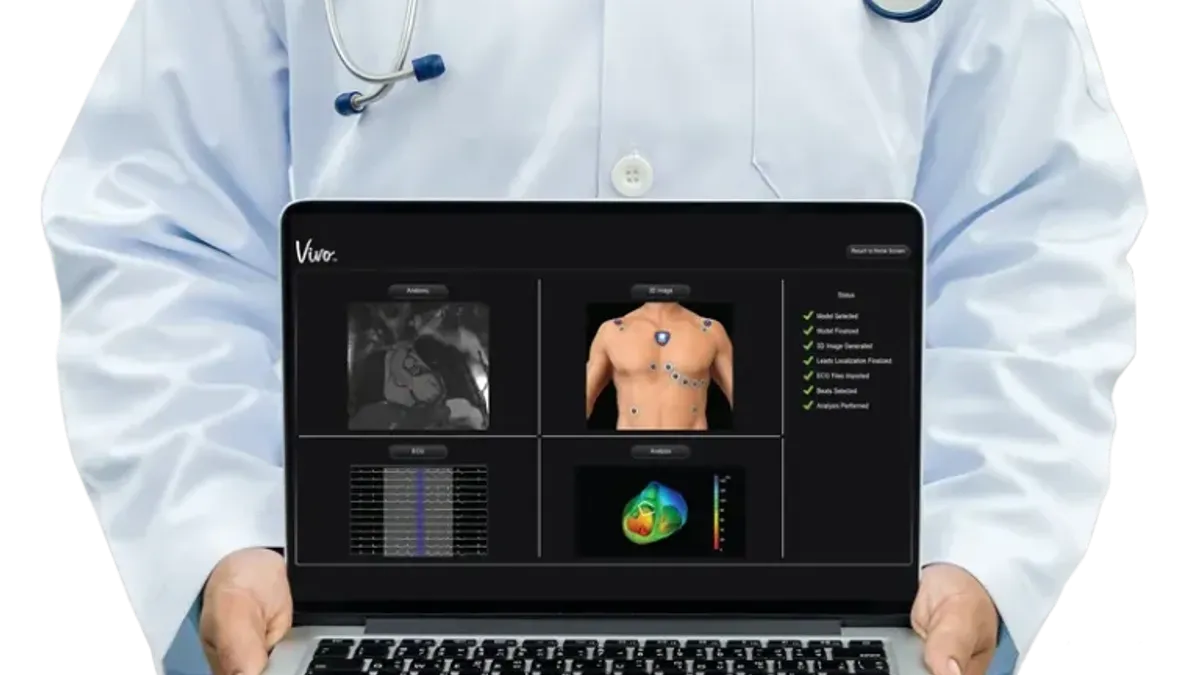

Catheter Precision agrees to reverse merger, securing cash to target cardiac electrophysiology market

By merging into Ra Medical Systems, Catheter Precision has access to public markets and a pool of cash needed to bring its product to market.

By Nick Paul Taylor • Sept. 13, 2022 -

Illumina’s hold on Grail depends now on separate appeals in US, Europe

Even as it plans to appeal a European Commission decision and the FTC plans to appeal a U.S. ruling, Illumina say it’s preparing for ‘strategic alternatives’ to its acquisition of early cancer detection firm Grail.

By Elise Reuter • Updated Sept. 7, 2022 -

Retrieved from Olympus on August 30, 2022

Retrieved from Olympus on August 30, 2022

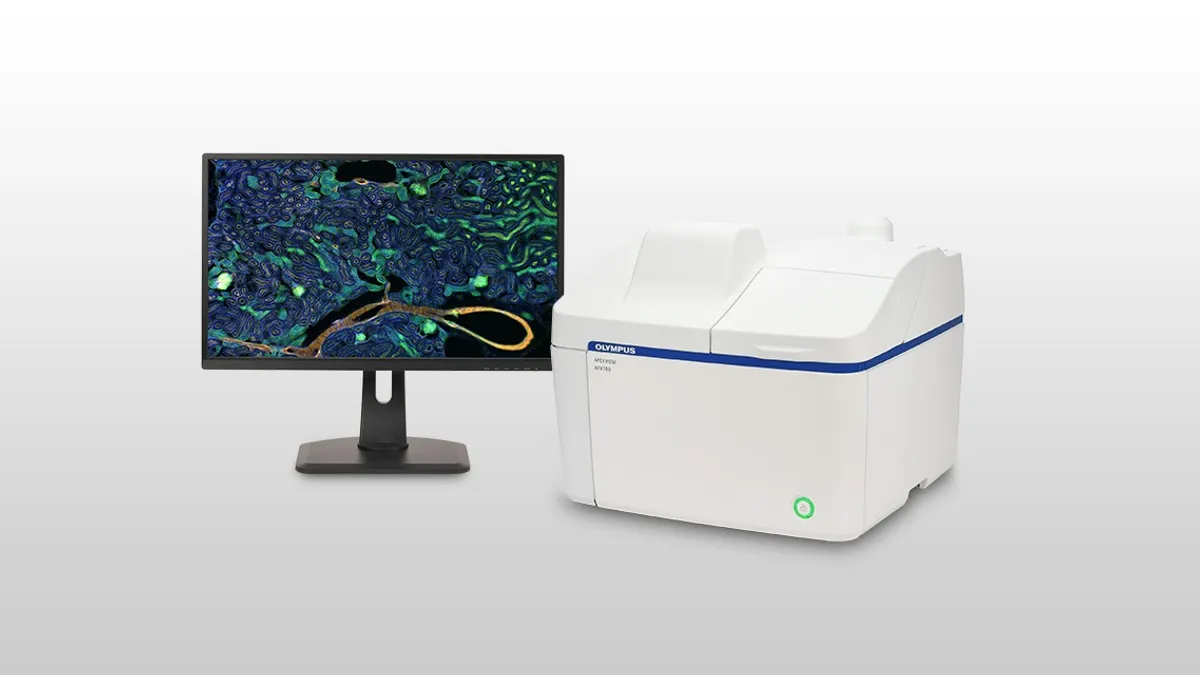

Olympus to sell microscope unit for $3.1B as it bolsters focus on medical technology

Bain Capital has taken the other side of the deal, paying $3.1 billion for a business it said is “at the frontier of digital optical technology in life sciences and industrial end markets.”

By Nick Paul Taylor • Aug. 30, 2022 -

Retrieved from NJ Medical School Website on August 25, 2022

Retrieved from NJ Medical School Website on August 25, 2022

Labcorp adds to hospital lab buying streak with New Jersey acquisition

The purchase comes as hospitals work to trim costs and testing firms seek stable revenue streams as COVID-19 testing winds down.

By Peter Green , Rebecca Pifer • Aug. 25, 2022 -

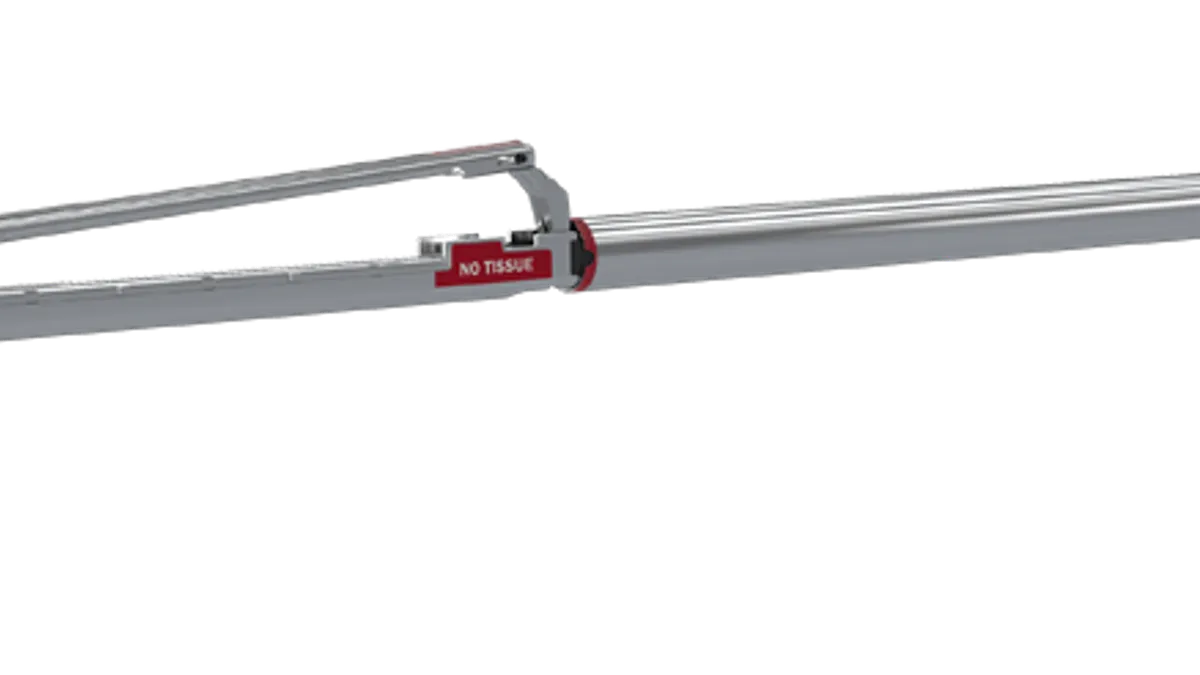

Teleflex will buy Standard Bariatrics for $170M to gain Titan stapler

Standard’s investors could receive an additional $130 million if the unit reaches certain commercial milestones under Teleflex’s ownership.

By Elise Reuter • Aug. 22, 2022 -

Akili raises $163M in ‘blank-check’ merger, plans to commercialize digital treatment for ADHD

Akili’s share price fell as much as 55 percent on the Nasdaq by mid-morning Monday, its first day of trading after merging with a special purpose acquisition company.

By Elise Reuter • Aug. 22, 2022 -

Boston Scientific acquires biomaterials firm Obsidio to bolster embolization business

Obsidio’s Gel Emobolic Material technology was cleared by the FDA in July.

By Ricky Zipp • Aug. 15, 2022 -

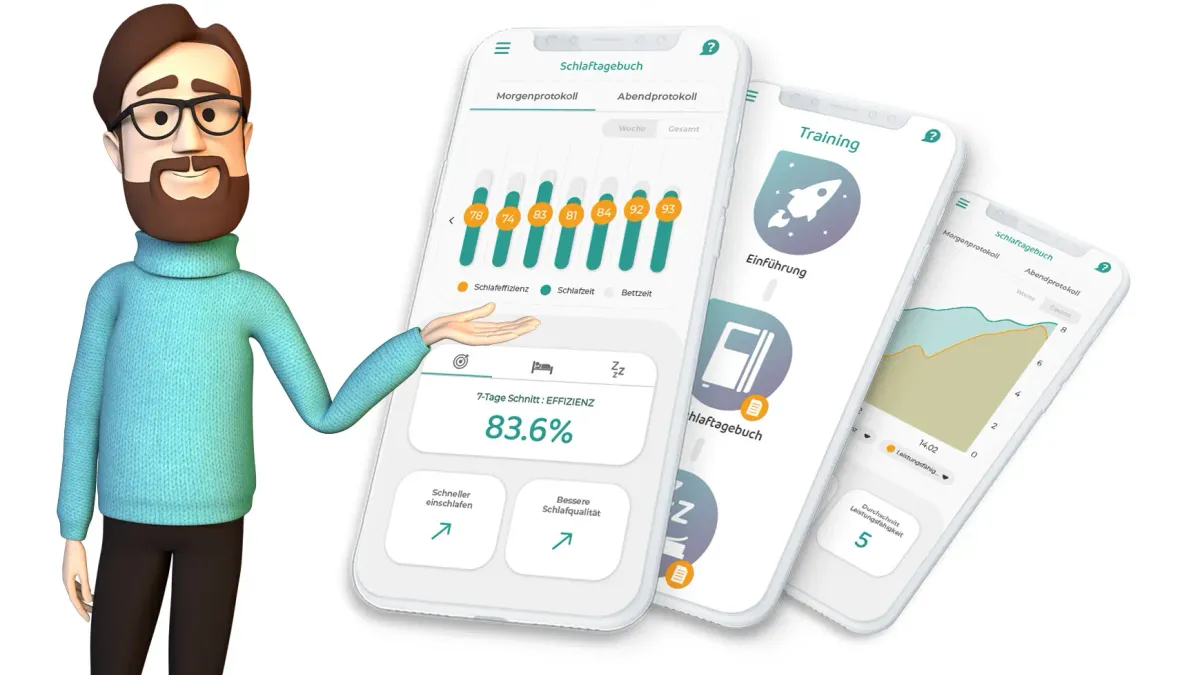

ResMed buys Mementor for prescription digital health app, continuing German expansion

ResMed will integrate the startup into its German operation as a separate business segment and use it as a platform for further digital health development.

By Nick Paul Taylor • Aug. 4, 2022 -

Illumina vows to fight EU efforts to block $8B Grail merger

Illumina acquired the liquid biopsy company in 2021, despite pending anti-competitiveness investigations on both sides of the Atlantic.

By Elise Reuter • Updated Aug. 2, 2022 -

BD buys MedKeeper for $93M to continue expansion into pharmacy technology

The company sees MedKeeper’s software as a solution for pharmacies facing COVID-related labor shortages.

By Nick Paul Taylor • July 29, 2022 -

3M to spin out its healthcare business

The decision comes amid spin-offs by several large medtech firms, including J&J and GE.

By Elise Reuter • July 26, 2022 -

AbbVie agrees to pay $60M for rights to acquire implantable glaucoma device

The biotech company said the deal is an opportunity to grow its eye-care business.

By Elise Reuter • July 20, 2022