M&A: Page 17

-

Steris inks $850M deal for Key Surgical adds to medtech M&A wave

CEO Walter Rosebrough gave a nod to current low interest rates but said Steris had been looking at this potential transaction "for years, not months."

By Susan Kelly • Oct. 7, 2020 -

Analysts predict Zimmer Biomet M&A in 2021 to speed growth

The medtech is likely to initially target private orthopaedic companies worth up to $300 million, Needham analysts specified. The spine and dental businesses, meanwhile, could be on the chopping block.

By Nick Paul Taylor • Oct. 7, 2020 -

M&A on horizon as deep-pocketed medtechs eye distressed assets: EY

The combination of smaller companies questioning their pandemic survival and larger companies with considerable capital may spark a buying surge, the consultancy said in its annual medtech report.

By Nick Paul Taylor • Oct. 6, 2020 -

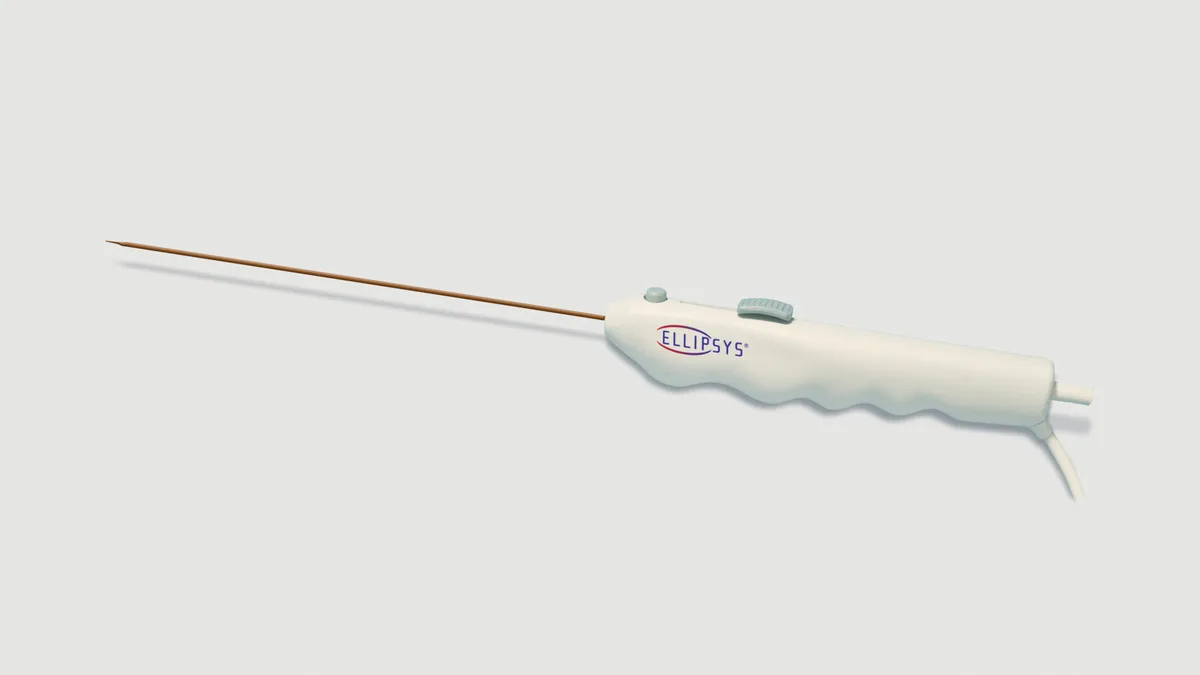

Medtronic to expand dialysis access position with Avenu Medical buyout

The deal is the second tuck-in acquisition this year for the medtech's peripheral vascular business and the company's sixth overall, following additions to insulin delivery, surgery and spinal cord stimulation offerings.

By Maria Rachal • Updated Sept. 30, 2020 -

COVID-19 spurred a medtech M&A boom this summer. Will it last?

Siemens Healthineers' CEO was rebuffed by his counterpart at Varian in January. But come May, the impact of coronavirus began to become clear.

By Nick Paul Taylor • Sept. 30, 2020 -

Smith & Nephew inks $240M deal to buy orthopaedic assets from Integra

The U.K.-based medtech will gain control of a portfolio of shoulder replacement products and other devices that generated revenues of $90 million last year.

By Nick Paul Taylor • Sept. 29, 2020 -

Illumina inks $8B Grail buyout for liquid biopsy market. Investors are not sold.

Shares in Illumina, which formed cancer detection startup Grail in 2016, fell as analysts questioned whether the cash-and-stock deal plays to its strengths.

By Nick Paul Taylor , Greg Slabodkin • Sept. 21, 2020 -

Qiagen completes takeover of PCR automation player NeuMoDx for $248M

The still-independent Dutch molecular diagnostics company said NeuMoDx devices process test results three times as fast as some rival systems.

By Nick Paul Taylor • Sept. 18, 2020 -

Intersect ENT strikes €60 Fiagon buyout to expand in balloon sinuplasty

The takeover of the German electromagnetic surgical navigation specialist comes two months after a report that Medtronic moved to acquire Intersect.

By Nick Paul Taylor • Sept. 16, 2020 -

Stryker reaches agreement with Colfax for Wright Medical deal divestitures

The medtech disclosed Thursday the orthopaedics competitor's DJO Global subsidiary agreed to acquire its ankle and finger joint replacement businesses to shore up U.S. and U.K. antitrust concerns.

By Maria Rachal • Updated Oct. 16, 2020 -

Stryker stretches Wright Medical share offer into Q4

As the medtech makes the fifth offer extension since the $4 billion acquisition was announced last November, the company is approaching the latest time it said the deal would close.

By Susan Kelly • Updated Sept. 29, 2020 -

Philips pens $275M Intact Vascular deal to acquire implant

The buy adds the first FDA-approved vascular implant for below-the-knee interventions to the Dutch conglomerate's portfolio.

By Nick Paul Taylor • Aug. 28, 2020 -

Hologic inks $80M Acessa buyout to expand women's health business

The cash acquisition, plus contingent payments based on future revenue growth, will add a treatment for benign uterine fibroid to the medtech's portfolio.

By Nick Paul Taylor • Aug. 26, 2020 -

IDx rebrands, buys 3Derm to expand automated AI portfolio

The takeover gives the company, now known as Digital Diagnostics, control of two breakthrough device-designated autonomous artificial intelligence systems.

By Nick Paul Taylor • Aug. 20, 2020 -

Medtronic seeks leg up in lagging pen market with Companion Medical buy

As Dexcom and Abbott grow share in the continuous glucose monitoring market and Insulet and Tandem forge on with interoperable insulin pump systems, Medtronic is hoping to jump ahead with a connected pen.

By Maria Rachal • Aug. 17, 2020 -

Thermo Fisher-Qiagen deal falls apart after failing to secure shareholder support

Thermo Fisher recently raised its bid for Qiagen shares, taking into account the company's COVID-19 testing gains. But when the offer expired Monday, less than half of shares were tendered.

By Nick Paul Taylor , Maria Rachal , Greg Slabodkin • Updated Aug. 13, 2020 -

Livongo scooped up by Teladoc in $18.5B deal

An explosion in the use of virtual care during the pandemic may have sped up the timeline for the merger. Both companies' share prices are down on the news.

By Shannon Muchmore • Updated Aug. 5, 2020 -

Americas drag on Qiagen as Thermo Fisher deal goes down to the wire

A hedge fund that owns 8% of Qiagen "fully" expects the Thermo Fisher offer to fail, calling it “wholly inadequate.”

By Nick Paul Taylor • Aug. 5, 2020 -

Varian sold to Siemens Healthineers in $16.4B all-cash deal

Breaking with a trend of smaller medtech deal values in 2020, the pact will see radiation oncology equipment and software maker Varian Medical Systems operate as an independent company under Siemens Healthineers.

By Maria Rachal • Updated Aug. 3, 2020 -

Coronavirus could fuel clinical lab M&A by stressing smaller hospital players

Consultancy Kaufman Hall predicts a ramp-up of deals throughout the year, as hospital-owned labs seek support amid the pandemic. That forecast meshes with comments from Quest's CEO last week.

By Nick Paul Taylor • July 29, 2020 -

Medical device deal values down 88% amid COVID-19 disruption: PwC

Going forward, M&A may rise in light of recent deferral of elective procedures, which analysts say “could create the need for significant consolidation as companies work to remain competitive.”

By Nick Paul Taylor • July 23, 2020 -

Thermo Fisher ups Qiagen offer by 10% after investor backlash cites COVID-19 growth

The acquisition was announced weeks before the U.S. doubled down on its need for widespread coronavirus testing, which provided a big business opportunity for Qiagen that it capitalized on during the second quarter.

By Maria Rachal • July 16, 2020 -

Medtronic closes Medicrea buyout, seeking spinal surgery boost

Four months after announcing the deal for the French medtech, Medtronic also highlighted its expanding foothold in AI, machine learning and predictive analytics.

By Maria Rachal • Updated Nov. 16, 2020 -

UK signals Stryker offer to unload ankle replacement product could clear Wright Medical buy

The medtech giant's proposed $4 billion acquisition prompted competition concerns among regulators. Stryker disclosed in a filing Wednesday it pitched divesting its STAR product line, which may satisfy U.K. authorities.

By Greg Slabodkin • July 15, 2020 -

Shareholder challenges Thermo Fisher's $11.5B deal to buy Qiagen

COVID-19 has made "significantly clearer" the importance of Qiagen's testing business, according to investment management firm Davidson Kempner, which is urging other shareholders to reject the offer priced in early March.

By Susan Kelly • July 13, 2020